Insights, Events and Videos

Ping An Business Case Series

Integrated finance meets satellite technology to promote green growth in China

Launching a satellite for financial inclusion

It is 12.37pm, lunchtime, three days before Christmas 2020. The Long March 8 rocket lifts off from the Wenchang launch site on the tropical island of Hainan. It is on a voyage to take five satellites into orbit. Soon, Ping An 1 will take its place in the heavens, watching over China from some 700km above the earth.

Big data empowerment from space

The deployment of Ping An 1 was a giant step in Ping An’s mission to take a leadership role in space-based Internet of Things (IoT). The world’s first financial IoT satellite, Ping An 1 enables the group to offer a range of supply-chain financial services to more businesses.

Small- and medium-sized companies across China are among its core beneficiaries. By effectively employing "IoT + Finance”, the platform addresses a key problem that SMEs often face when attempting to obtain financing at reasonable cost — notably a lack of the reliable and verifiable data that finance providers need to approve loans.

Essentially, Ping An 1 is a big-data machine supporting Ping An’s Nebula IoT platform, which is a state-of-the-art cloud system connected to more than 10m IoT devices that are collecting and monitoring real-time data across the production and supply chain here on earth.

With this platform, for example, in the case of the animal husbandry industry, wearable IoT devices for dairy cows can allow the group to monitor in real time a farm’s inventory, milk production rates and other operational data to assess default risks.

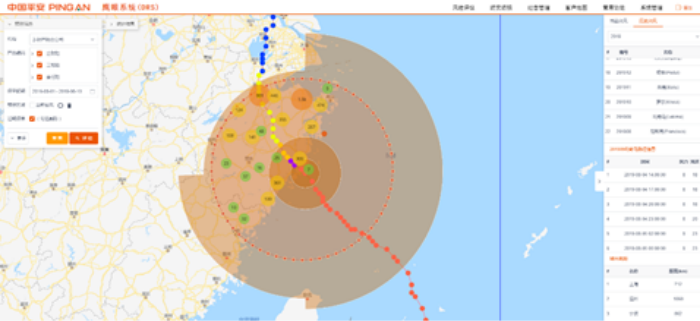

Meanwhile, Ping An’s Digital Risk System (DRS) is an AI platform for physical risk identification, analysis and management that is crunching the data. The DRS deploys proprietary algorithms to analyse more than 14bn data sets relating to the weather, flooding and seismic activity going back centuries.

With the DRS, Ping An can divide China’s landmass of some 9.6m sq km into significantly smaller, manageable plots and assess each one for risk, providing the group with granular insight into calculating insurance premiums — a benefit to both the insurer and the insured — and anticipating disasters before they happen.

The DRS can also help forecast storms and droughts, enabling timely warnings that save lives and property, and the mobilisation of rescue efforts when calamities strike. By assessing risk using real-world data, Ping An is able to provide farming communities with cost-effective financial protection, encouraging financial inclusion while growing its customer base.

Riding the storm with digital solutions

The benefits of the DRS were seen this summer, when China’s Henan province suffered severe flooding due to record rainfall, leaving 302 dead and resulting in the evacuation of 815,000 people. Thanks to the DRS, Ping An was able to respond quickly, mobilising rescue and claims forces from across the country. By September, related claims totalled more than Rmb3.4bn.

When Typhoon Mangkhut was heading for China’s Guangdong province in October 2018, Ping An was on hand to support hundreds of businesses and communities, with the DRS mapping the storm’s trajectory against client assets and enabling AI-driven risk management guidance.

The system identified more than 8,000 customers in the typhoon landing area, sending over 13,000 SMS warnings and conducting on-site risk assessment for roughly 400 enterprises and construction projects, thereby helping Ping An’s clients to minimise losses.

Ultimately, as president and co-chief executive officer Xie Yonglin said in the group’s 2020 sustainability report: “Ping An is dedicated to influencing society through finance and technology, creating value for its shareholders, clients, employees, communities and environment.”

The group’s technology-powered solutions are helping to drive China’s broader mission to transition from rapid growth to quality growth based on research and innovation, as called for in the country’s latest five-year-plan.

Increasingly, the “quality development” that Beijing wants is synonymous with green development, as evidenced by China’s targets of reaching peak CO2 emissions by 2030 and carbon neutrality by 2060. CEPII, France’s main research institute for international economics, believes Beijing intends to drive its long-term economic success according to ESG principles, seeking to boost quality of life across society.

“This [aims to] enhance the welfare of an enlarged middle class in accordance with deep social reforms to pursue and amplify the reduction of social and territorial inequalities and to shift resolutely towards a low-carbon economy,” the think tank said.

Indeed, Ping An believes its integrated finance model can play a prominent role in China’s vision of equitable, sustainable development. After all, the company’s future depends on its ability to develop next-generation tech to fight climate change, which threatens farming, water resources, energy generation and industrial projects — all key areas in Ping An’s insurance ecosystem.

Proactive ESG commitments

In April, Ping An issued a “Letter to the Earth” that laid out its commitment to supporting China’s environmental goals through green innovation, green investment and green insurance products. As an early adopter of the UN Principles for Responsible Investment (UNPRI), Ping An has pledged to support China in its transition to a sustainable economy with financial incentives for ESG projects, including preferential interest rates and insurance rates.

Ping An will meet its commitments under UNPRI through responsible investment and sustainable insurance. Specifically this will mean annual growth rate targets for green investments of no less than 20 per cent, green insurance premiums of 70 per cent or more, and a green credit balance of no less than 20 per cent.

Ping An has also set targets for green investment and credit of Rmb400bn and total green insurance premiums of Rmb250bn by 2025. The group will gradually reduce loan financing for industries and enterprises that are highly polluting or have high energy consumption or overcapacity.

Meanwhile, in its own operations, Ping An is committed to being carbon neutral by 2030, leveraging its own technologies while also supporting innovation in renewable energy, energy efficiency, carbon capture and trading, and other environmental fields.

“As a financial group based in Shenzhen and aiming for the globe, relying on the double engine of finance and technology, Ping An has been committed to the UN Sustainable Development Goals,” co-chief executive officer Jessica Tan said in the aforementioned sustainability report. “Especially zero poverty, zero hunger, inclusive finance, better health care and sustainable urban facilities.”

For more Ping An business cases series, please read here

Article 1: How integrated finance ecosystems are empowering millions in China

Article 2: How integrated finance is changing for Chinese healthcare

Article 3: How changing demographics pushed China’s biggest insurer to disrupt the life insurance industry