Integrated Finance

Group operating profit growth drivers

Ping An’s integrated finance model enhances operational efficiency, mainly through lower customer acquisition costs, higher customer retention rates, and reduced management and service expenses. The strategy focuses on developing retail customers with a customer-centric approach, using the “one customer, multiple accounts, multiple products, and one-stop services model.” This model leverages technology and compliant data analytics to gain precise insights into customer needs.

Ping An has unique advantages in implementing the retail integrated finance model:

- Full suite of financial licenses – With licenses in insurance, banking, and asset management, Ping An provides comprehensive financial services in China. Under this model, member companies collaborate closely to improve customer acquisition, activation, migration, and retention and to reduce operational and risk costs

- Market leadership in China – The Chinese mainland is the key market for Ping An’s integrated finance business. Ping An Life is the second-largest life insurer in China by premium income. Ping An Property & Casualty is the second-largest property and casualty (P&C) insurer in China by premium income. Ping An Asset Management is the second-largest insurance asset manager in China by assets under management (AUM). Ping An Bank ranks firmly among China's top joint-stock commercial banks by a combination of assets and net profit.

- Extensive online-to-offline channels – Offline, Ping An has over 1.3 million sales service agents and more than 7,000 outlets for various services covering all provinces and cities across China. Online, Ping An offers multiple apps to provide convenient services and premium products. Apps include, Ping An Jin Guan Jia, Ping An Pocket Ban, Ping An Auto Owner, and Ping An Health.

- Advanced proprietary technology –With a leading operations center in Asia, artificial intelligence (AI) service representatives handled customer interactions

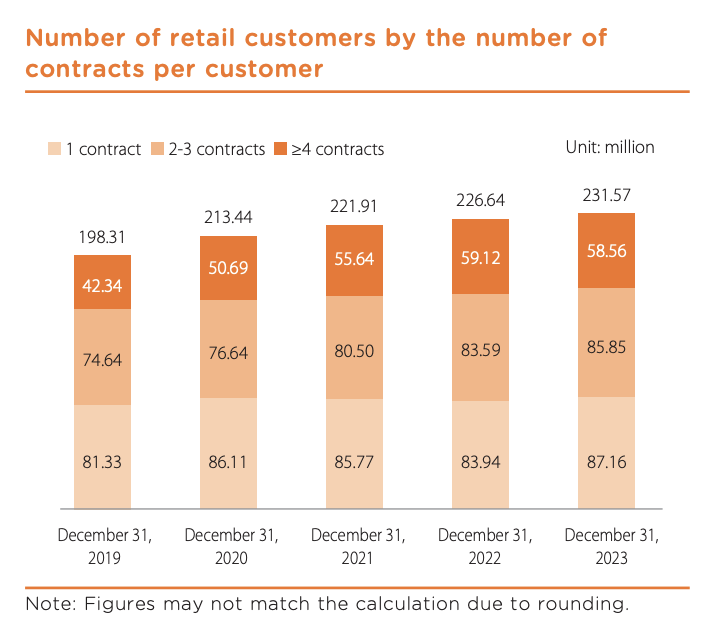

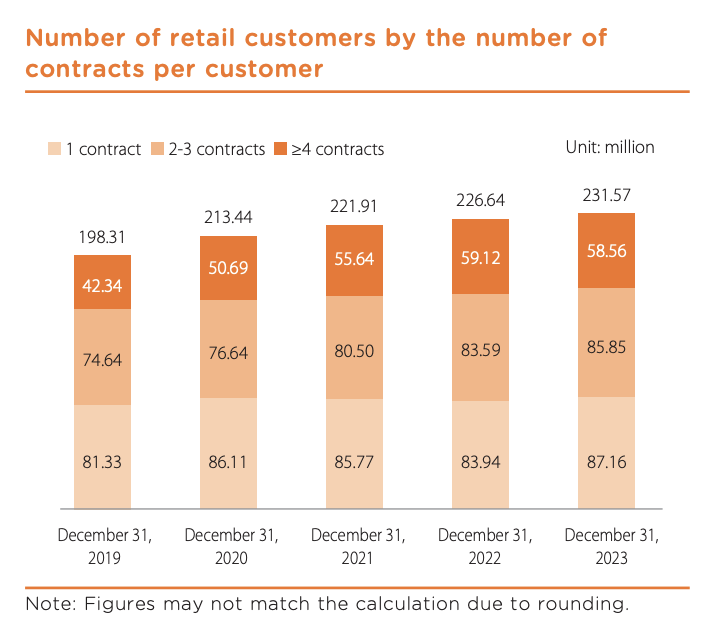

Ping An’s expanding retail customer base, steadily increasing number of contracts per customer, and strong product profitability is driving Ping An’s sustained growth in its retail business.

- Number of retail customers: Ping An’s retail customers increased 1.9% in the first six months to 236 million as of June 30, 2024. Of these, 24.9% of them held four or more contracts within the group, with a retention rate of 97.8%.

- Contracts per customer: Over 87.92 million retail customers held multiple contracts with different subsidiaries of the Group as of June 30, 2024. Average contracts per retail customer reached 2.93 as of June 30, 2024. Retail customers and contracts per retail customer have increased by 19.0% and 9.7%, respectively, since December 31, 2019.

The more contracts a customer holds, the higher the customer retention rate

Increasing the number of contracts per customer is key to boosting profit and reducing customer churn. Continuous customer development leads to more contracts per customer and higher customer retention.