Insights, Events and Videos

Ping An Business Case Series

How integrated finance is changing for Chinese healthcare

Synergy between insurance and healthcare, as well as superior online-offline medical services, can usher in a new era of wellbeing in China

Of all the assets one can possess — from securities or a home to a priceless Ming vase — none more is precious than good health. And quality healthcare, underpinned by caring financial support, is one of the most important services a company can offer.

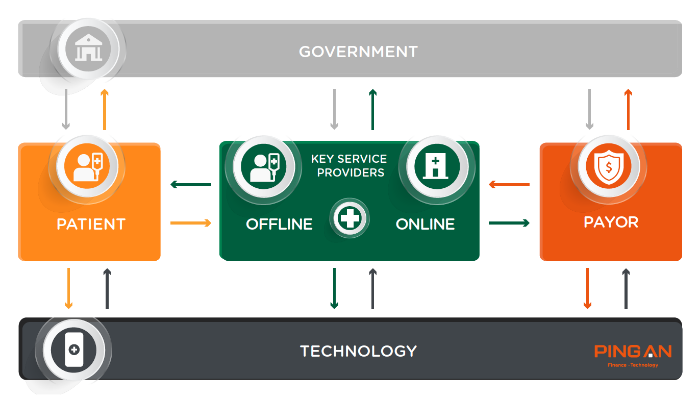

That is why Ping An is placing a new integrated financial services model that puts

its unified healthcare ecosystem — connecting patients, doctors, hospitals, government and payers in online-offline — at the centre of its vision for a better, more equitable China.

Seven years ago, Ping An launched Ping An Good Doctor and made a commitment that it would contribute to China’s mission to create a healthy society by 2030. Ping An Good Doctor integrates an AI-powered telemedicine platform with an offline healthcare network to offer holistic quality care. The mission of this unicorn is to connect hospitals, users, insurance payers, service providers and other stakeholders in a closed-loop healthcare ecosystem.

Since then Ping An has expanded its healthcare ecosystem, adding two new technology-driven components: Ping An Smart Healthcare deploys advanced AI-assisted tools for diagnosis and treatment, while a digital risk-management platform for insurers provides the data that underpins Ping An’s vision of human-centric health insurance.

The extent of Ping An’s financial services and healthcare integration strategy can be seen in the numbers. At the end of June, Ping An’s smart healthcare solutions covered 170 cities, empowering more than 40,000 medical institutions and benefiting about 950,000 doctors. And Ping An is now embarking on a significant enhancement of its ecosystem model.

Caring insurance plus world-class hospital care

Earlier this year, Ping An acquired Peking University Founder Group (PUFG), which is synonymous in China with quality healthcare and prestige. The acquisition gives Ping An the offline hospital resources to further develop an integrated healthcare service model that empowers people in all life scenarios.

These might range from world-class hospital in-patient care to AI-assisted diagnosis of thousands of ailments, complemented by caring insurance services that help people plan for the future. The new finance-plus-healthcare service model integrates Ping An’s core insurance business with PUFG’s world-class hospital services and capabilities to provide affordable, quality healthcare care in a nation of more than 1.4bn people.

This new healthcare ecosystem drives synergies with Ping An’s core businesses. Last year, more than 60 per cent of Ping An’s 218m-plus financial customers used services provided by its ecosystem. Over the past four years, 15-20 per cent of Ping An’s new financial customers each year were sourced from the healthcare network.

Integrating healthcare and finance has benefits for both. Professor Wang Shan, former head of Peking University People's Hospital, observed that medical business is a long-term investment and should be run together with a non-medical institution, such as an insurance or financial services leader, to ensure short-term profit.

“A mature business model is one in which the medical services drive the profitability of the non-medical business, and the latter in turn supports the development of medical services,” Wang said.

Looking across the ocean for a new model in Chinese insurance

Proof of concept for this finance-plus-healthcare ecosystem business model can be found on the other side of the Pacific. A similar ecosystem transformation was achieved by healthcare giant UnitedHealth, which revolutionised health services in the United States with a closedloop business model integrating medical services and health insurance.

The acquisition of PUFG was a significant enabler in Ping An’s goal to become the “UnitedHealth of China''. Integrating the elite medical services of PUFG into Ping An’s ecosystem means the company is developing a new model of healthcare services with similarities to that of the American group, with emphasis on smart healthcare, caring insurance, multiparty connectivity, physician networks and R&D investment. Ping An is building a Health Maintenance Organisation (HMO) system that gives health insurance customers access to a network of doctors and healthcare providers.

UnitedHealth today is the largest medical insurance company in the US, and Ping An is confident that it can implement a successful version of the model in China, providing a path to business success and patient empowerment.

Ping An chairman Peter Ma has long emphasised that finance plus healthcare represents the future of Ping An — within the broader framework of the company’s integrated finance model. He said at a recent life insurance summit that the “insurance plus health management” model is due to usher in a new era for the life insurance industry. Ping An believes its acquisition of PUFG is a key element in this strategy.

Ultimately, PUFG’s elite hospital services and capabilities complement Ping An’s digital ecosystem and core insurance business, forging a stronger group-integrated financial services platform. The PUFG brand will enable Ping An to expand and build networks with healthcare partners across China, to offer comprehensive healthcare services in key cities and regions.

In October, Ping An opened its first health management centres, in Beijing and Shenzhen, leveraging resources from respected Chinese hospitals — including Beijing University International Hospital — that offer high-quality preventive, medical and rehabilitation services.

By achieving online-offline synergies with PUFG, Ping An can cater to more customer health scenarios, from bouts of the flu to diabetes conditions and complex cancer treatments. And as well as offering a comprehensive arsenal of healthcare services, Ping An is now also collaborating with PUFG to pursue advanced medical research, in the same way that UnitedHealth entered into research partnerships with leading institutions such as the University of California.

To be sure, there are key differences between the two. Ping An started from insurance and moved into healthcare, whereas UnitedHealth began as a medical provider that then integrated insurance into its value chain. Yet they share the same core belief that integrated health and insurance services, built on digital transformation, represent the future of healthcare.

Through the synergies of online and offline healthcare — and medical services with human-focused insurance — Ping An is driving a new model of “heart-warming” services that put patient needs first.

A recent commentary in China’s 21st Century Business Herald said: “The most important thing for an insurance company is the organic linkage with medical institutions. It all boils down to the simple fact that the fundamental purpose of users buying insurance is not to claim large sums of money, but to access better healthcare resources when needed for a better lifestyle. UnitedHealth did that and was an early starter.”

In a recent speech, Ping An chairman Ma added: “Heart-warming insurance must be developed with the help of technology. With the support of Ping An’s technology-driven healthcare ecosystem, insurers can not only meet customers' insurance and financial requirements but also their long-term regular needs in medical care, health, senior care and daily life.”

For more Ping An business cases series, please read here

Article 1: How integrated finance ecosystems are empowering millions in China

Article 3 : How changing demographics pushed China’s biggest insurer to disrupt the life insurance industry

Article 4: Integrated finance meets satellite technology to promote green growth in China