Insights, Events and Videos

The Ping An Auto Owner app is capturing the huge potential for online services for car owners in China – demand driven by double-digit growth in used car sales and the automotive aftermarket, which includes vehicle parts, replacement tires, maintenance and repairs and accessories.

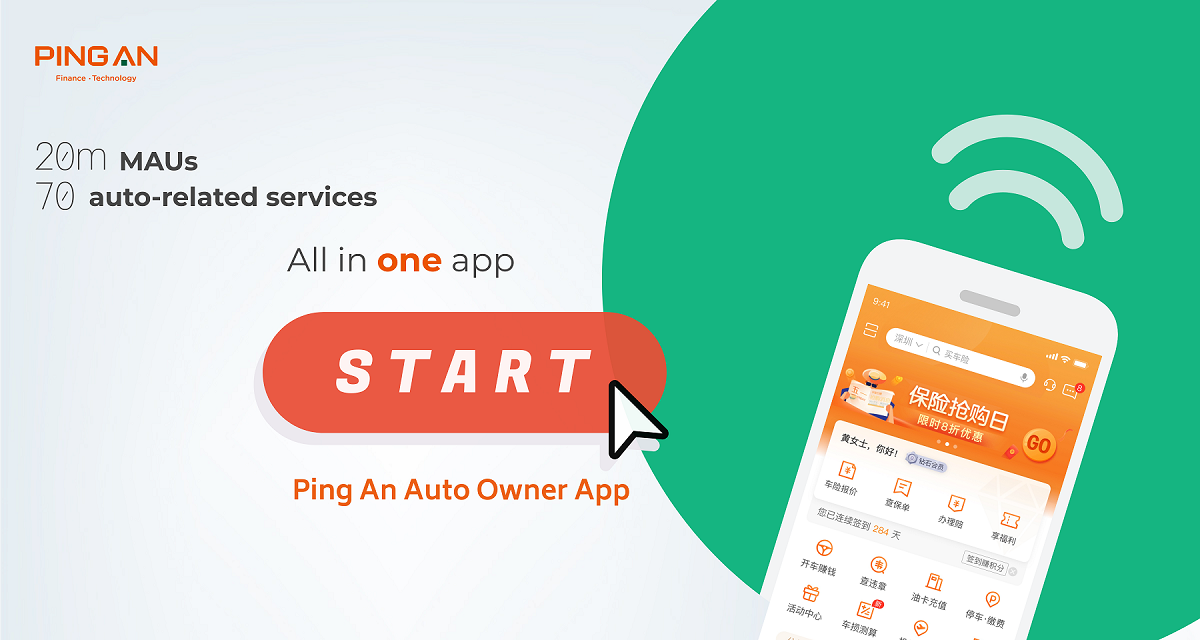

The smartphone app, launched by Ping An Property & Casualty Insurance in September 2014, is a market leader. In just five years, the app grew to more than 20 million monthly active users by September 2019 and a total of more than 79 million registered users. The potential for continued growth is significant: China reached 198 million registered private cars and 380 million registered drivers as of June 2019.

Ping An Auto Owner offers smart services developed by Ping An and a platform to connect users to car dealers and other auto services. The app offers more than 70 smart butler-style auto insurance and car-related services, which use digital technology to simplify the often-complicated processes of obtaining auto insurance, maintenance, repairs and roadside assistance. It also connects users to more than 25,000 maintenance chains, 20,000 repair plants and 10,000 4S (sales, service, spare parts and surveys for customer feedback) car dealerships.

Innovative technology for great customer experience

The app is supported by innovative new technologies for day-to-day driving, insurance claims and roadside assistance.

- Automatic identification and classification of personal identity and financial documents, certificates and pictures

- Robot-assisted interaction with app users, based on natural language processing, optical character recognition, voice recognition and voice to text technologies

- Internet-based smart risk-control and fraud prevention measures for various car insurance claims scenarios

- Know Your Driver (KYD) insurance claims risk forecasting based on drivers’ facial features and modeling

The app also includes AI image-based vehicle damage assessment technology, which allows drivers to assess their vehicle damage for free with 95% accuracy. Another function, based on big data analytics and algorithms, records and analyzes drivers’ behavioral data for them to correct their bad driving habits.

Pioneering big data analytics in post-sales services and assistance

Big data analytics has transformed the insurance industry, particularly the stages of pricing and underwriting and claims management and sales and distribution. Ping An Property & Casualty Insurance is one of the few pioneering operations to use big data analytics in post-sales services and assistance.

The Ping An Auto Owner app is a critical tool in the development of a one-stop car owner ecosystem. With such a large user base that is continuing to grow, the app enables Ping An Property & Casualty Insurance and other service providers to use big data analytics to tailor to car owners’ preferences and habits.