Insights, Events and Videos

How did a small insurance firm starting in property and marine hull insurance get to become one of the largest insurance companies in the world with 200 million customers and more than 600 million internet users in its four lifestyle ecosystems in healthcare, financial services, car services and smart city services.

This series tells that story.

In previous chapters, we learned that Ping An started in property and casualty in the late 1980s, developed life insurance and then decided to become an integrated financial services model company for China. The foundation was laid in the early 2000s with the company ripping up its sprawling national back office infrastructure and centralizing it at a new 44-acre site the National Integrated Operations Centre in Zhangjiang in Shanghai in October 2006. That was one of the first steps in the integration of Ping An’s businesses under one umbrella.

The importance of the integration platform model

Financial services behemoths the world over are saddled with multiple back offices, and layers of legacy systems on old mainframe technology that silos processes and data. They become more expensive to maintain every year. These arrangements result in high costs, inflexible systems and opaque data access. This chapter looks at Ping An’s struggle with this problem and its solution. An integrated model paved the way for the company to embrace new technologies in the future like Web 2.0, digitalization and artificial intelligence (AI). This enabled the company to achieve peer-leading business growth, best-in-class customer services and market-leading returns to shareholders.

The dream of integration: few have succeeded

The road to the integration of businesses in financial institutions has been a difficult one the world over. There has not been an insurance chief who has been successful in banking or vice versa.

The merger of U.S. banking giant Citicorp and the insurance company Travelers Group in 1998 is case in point. The two corporations wanted to create the world’s largest financial services company with banking, insurance, and investment operations around the world. The combined corporation became the largest financial services company globally and was renamed “Citigroup”.

This “merger of the century” of Citicorp and Travelers Group resulted in the first truly global financial services supermarket which offered products from traditional banking to brokerage and insurance policies.

But the marriage was not long to last.

Not long after the merger, Citigroup sold the insurance business. The reason was simple: the price-earnings (P/E) ratio of the insurance business was much lower than that of the banking business. Following the spin-off, the P/E ratio of Citicorp increased, and uneasy investors were appeased.

These international failures of the integrated financial services model, gave Ping An founder Peter Ma a lot to think about. There could be many skeptical investors and stakeholders. However, he did not give up on his dream of creating a leading integrated financial services company in China.

When Mr. Ma was discussing his integration idea with others, he considered the situation in China different from other countries. The growth potential of the financial industry in China was greater than in the West, with potentially higher revenues. The run rate for return on assets (ROA) would be above 1%, while that for return on equity (ROE) could reach 16% to 20%, one of the best in the world. Mr. Ma’s analysis gave him the courage to pursue his dream of integration at Ping An. Given the expected financial services market trajectory, he predicted the success rate of the combined businesses would be much higher than that of other international financial conglomerates.

Ping An’s next step up: development of an integrated finance platform

Integrated finance requires a common platform where information and technology can be shared and managed centrally.

Sun Jianyi, a graduate in economics and law, joined Ping An in 1990 and has served in different management positions in Ping An. He said the group started seriously pursuing integration in the late 1990s. “At that point we realized the competition in the market has transformed into a cost competition.”

In such an environment, he said, “costs could only be lowered with the benefits brought by financial integration and enabled by technology.” Technology was set to transform the industry and the world with the advent of internet. Mr. Sun said Ping An embraced the new technology. “The development of the internet has assisted Ping An a lot in the integration. The Zhangjiang Operations Center is a product of its time.”

With the integration platform in place, the company was able transform its back office operations. This came in four stages. From 2000 and 2003, Ping An integrated underwriting and claims settlement amongst the provinces in China, and consolidated the data room. From 2004 and 2006, Ping An integrated all the insurance businesses in the country. The establishment of the RMB1 billion National Integrated Operations Center in Zhangjiang, Shanghai in October 2006 bolstered to development of a central integrated finance platform for the group. The company was now able to integrate back-office operations of its brokerages, trust and banking businesses. Between 2007 and 2009, Ping An integrated the non-insurance businesses.

The fourth integration started in 2010, integrating a broader spectrum of activity, such as processes and data for customer services branches across the country, investigation officers and claims investigation businesses.

The Zhangjiang operations center enabled the company to apply new management control techniques across the whole company, to lower costs, enable sales and cross- sales and establish a one-stop service for customers.

The four stages of integration placed the company on a new footing, with a flexible integrated management platform through which it could manage costs and risks, and manage customer relations and services more effectively. The integration concentrated the group’s frontline, middle office and back office operations under one umbrella. This process brought its own issues, which Ping An needed to face and solve, to ensure the proper separation of different line management segments, functions, customer information and services.

Ping An’s integrated finance structure: separate operations

The separation of operations across line, function and segment was an issue Ping An worked on for many years. In an interview with The People’s Daily newspaper in May 2001, Mr. Ma talked about the importance of the concept of separate operations in Ping An Group.

“The financial institutions in China and that in the Western world are at different stages of growth: the latter have been developing for a few decades while those in China are just starting out,” he said. “The professionalism of the financial institutions in our country is relatively lower than our Western counterparts. The abilities to control and manage risk are also relatively limited.

“If the risks faced by these institutions in China are not well controlled, they may be exposed to further systemic and global risks. Therefore, it is vital for these financial institutions in China to run their businesses within the group separately, so that each of these businesses are subject to separate regulations, which would benefit the professionalism and resilience of the group business overall.”

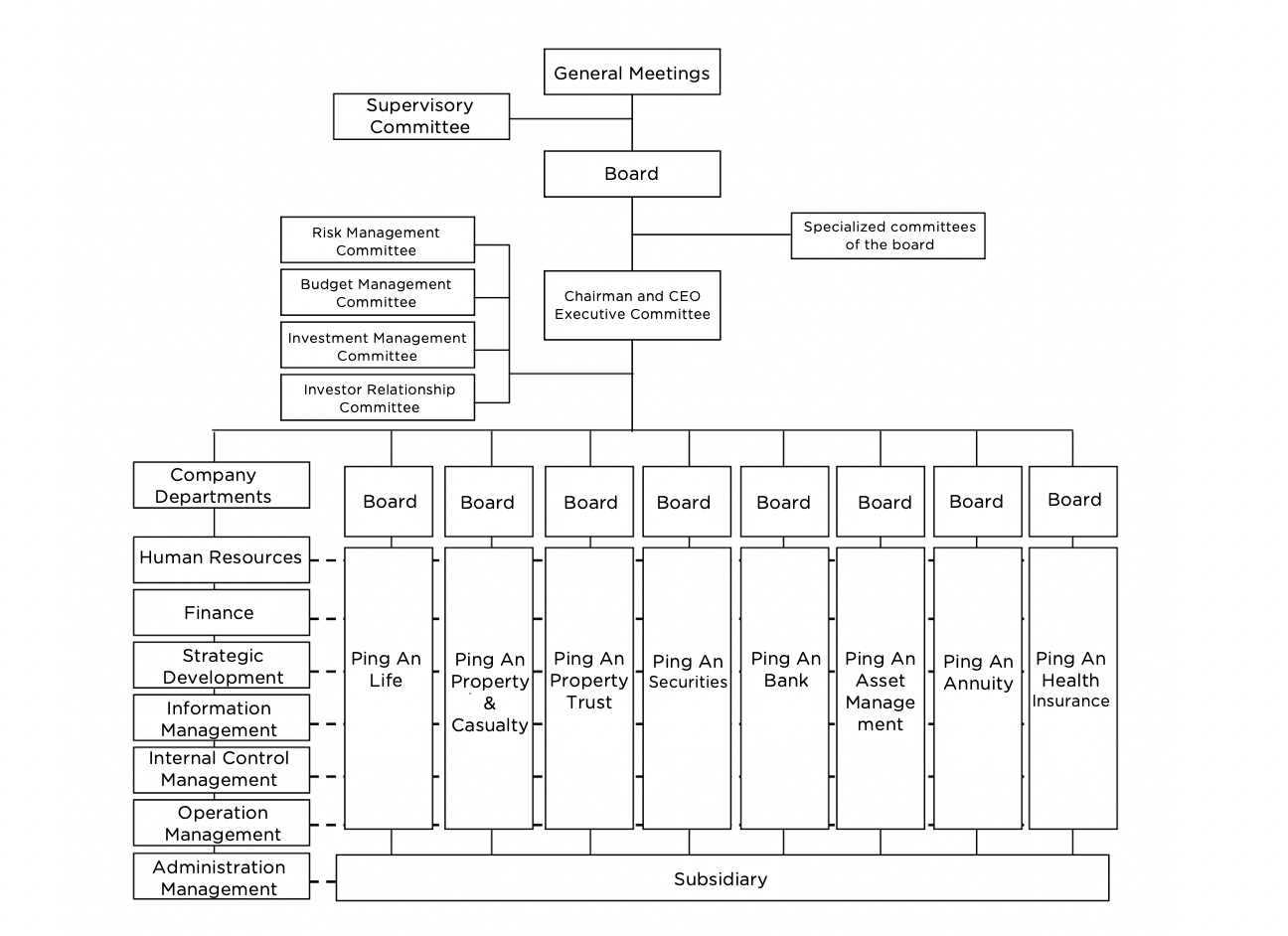

This separation of function and operation was to form the backbone of Ping An’s integrated finance structure. Mr. Ma set out this structure in the Ping An’s A-share listing in Shanghai in 2007.

Group strategic and capital-raising structure

Mr. Ma said that first, the group holding structure of Ping An should not engage in specific business operations. The group should be responsible for strategic development of the business, management of the assets of the group on behalf of its shareholders and monitoring of the group’s overall business. Through its listings on the Hong Kong and Shanghai stock exchanges, Ping An’s group holding structure would be able to raise capital from the public and distribute them across its subsidiaries, as opposed to using capital sourced from its own subsidiaries.

Group + subsidiaries regulation and management

Second, under the structure of integrated finance holding group, the group itself is regulated by China Banking and Insurance Regulatory Commission (CBIRC), while its subsidiaries are regulated by their respective authorities and the group, effectively enhancing the risk control of the group and its businesses.

Business + subsidiaries operations

Third, although separate operation of the businesses are subject to separate regulations, under the structure of the integrated finance platform, the various businesses of the group all benefit from the good reputation of the group, a unified information technology back-office operations center, loyal customers, effective risk control ability, extensive network, and excellent service.

Regulatory recognition of Ping An structure

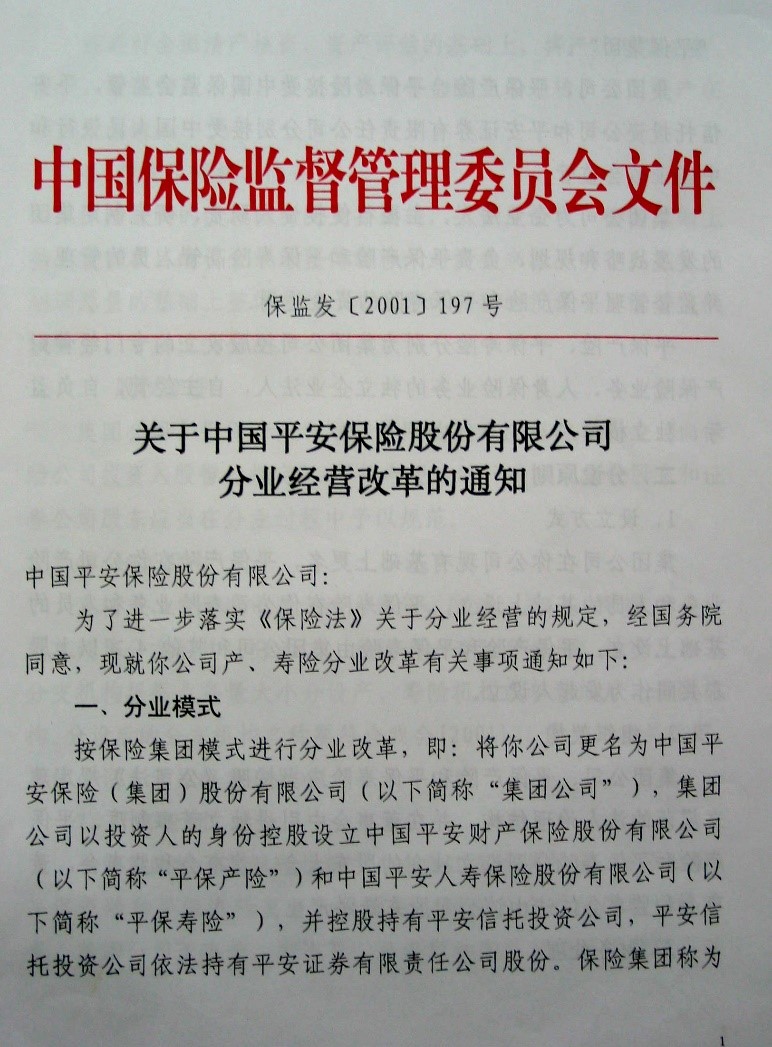

On Dec. 7, 2002, the CBIRC issued an announcement to Ping An, acknowledging its reform of the management of its own businesses using the separate operation model.

On Feb. 14, 2003, Ping An announced that its name changed from “Ping An of China Insurance Company Limited” (中国平安保险股份有限公司) to “Ping An Insurance (Group) Company of China, Ltd” (中国平安保险(集团)股份有限公司,becoming the third financial holding group after China Everbright and Citic, and the only insurance financial holding group in China.

Mr. Ma commented: “Don't make excuses for failure but find reasons for success.

“Success often appears in the effort of taking one more step forward. The spirit of exploration is ingrained in Ping An. Facing different challenges ahead, Ping An is now walking out on its new road of financial integration, without turning back, all the way going forward.”