Insights, Events and Videos

China’s fast-aging population presents both challenges and opportunities for insurers targeting a burgeoning new “silver” economy in elderly care services.

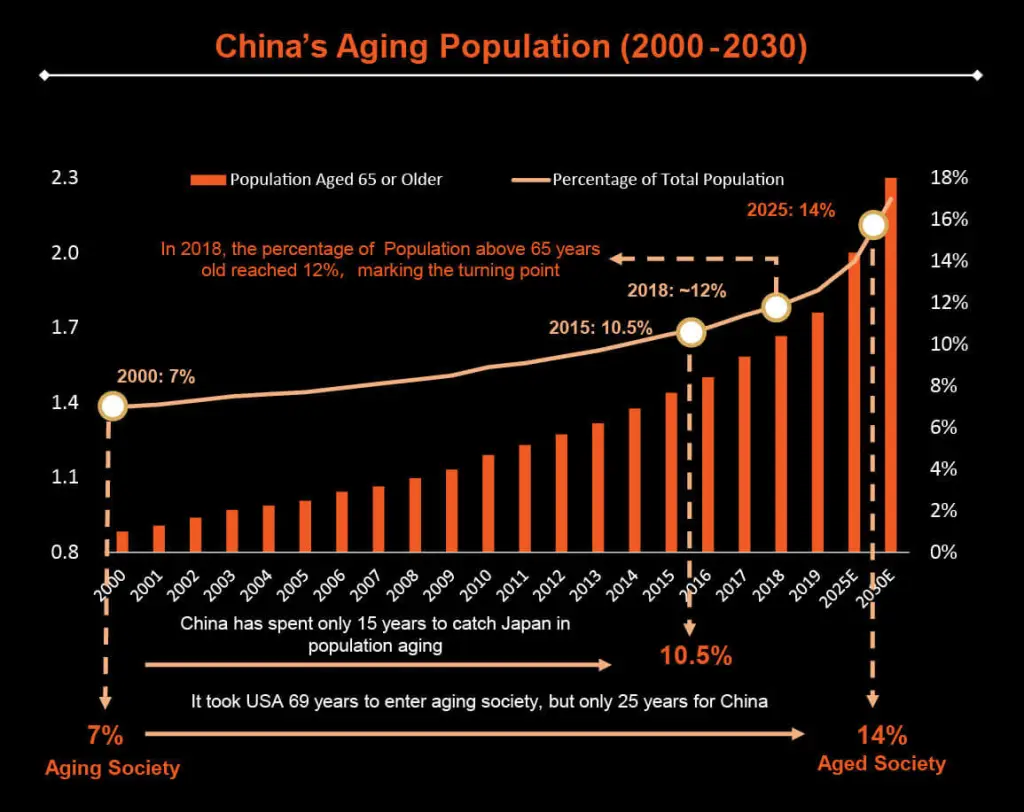

China’s society is aging. China has the largest and fastest-growing pool of elderly on the planet, creating challenges for society, the economy and policymakers. China was officially labeled an aging country in 2000, when the population aged 60 and over reached 10% of the total. According to the Renmin University of China, this rapid-aging phenomenon is being driven by a low birth rate and increasing longevity. The World Bank reports the average life expectancy in China has risen from 44 in 1960 to roughly 76 today, fueling China’s aging demographics. The number of people aged 60 and over is forecast to reach nearly 500 million by 2050. Those aged 65 and over are expected to reach 370 million, roughly a third of the total population, or nearly double the 191 million adults aged 65 and over today. By comparison, the population of the United States is 330 million, and that of the European Union is 447 million.

To tackle the aging population challenge, China committed to a new policy: Healthy China 2030. Aging is associated with a rising prevalence of illness and medical conditions. The Healthy China policy is aimed at promoting a healthy society through the integration of health and elderly-care services. Another policy commitment, 9073, aims to provide for 90% of the growing elderly population to be looked after at home, 7% in community care and just 3% in institutions. The aging population also presents the private sector with a new opportunity to participate in China’s burgeoning silver economy.

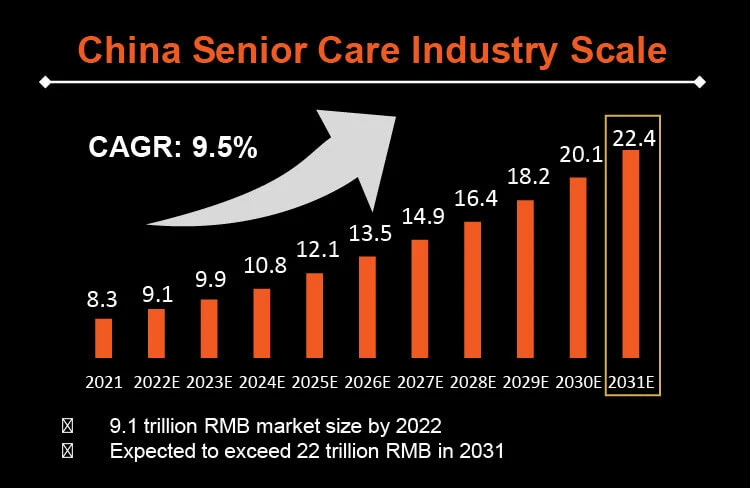

Ping An Insurance Group Co-CEO Jessica Tan says: “The entire senior care industry is expected to exceed 22 trillion yuan [$3.25 trillion]. So this demographic evolution raises both opportunities and challenges.” The country’s aim is to allow its citizens to easily access affordable treatment, and preventive, rehabilitative and long-term care services. Analysts say an aging Chinese population presents a huge opportunity for the private sector to turn longer life spans into an advantage that will help people live independently for much longer and mitigate the notion of seniors becoming a burden on society.

Ms. Tan says: “The vision for us is that when you retire, it’s a new beginning. We want you to be healthy, fulfilled and lead a wonderful life.” The company has created an insurance plus elderly care model. The first part of the model, aligned with the 9073 policy, is a home-based care mode. It offers a dedicated butler and a family doctor online, reachable around the clock. Ping An is able to provide over 650 services that can be delivered at home.

The other model is high-end retirement centers. The centers integrate global expertise in the best of senior wellness to provide bespoke services within the retirement homes in the city center. The service includes advanced health and rehabilitation facilities as well as recreational activities, so that clients feel that they are living with like-minded folk.

Ms. Tan says Ping An aims to set a new benchmark for elderly care in China. “We really have three capabilities: our strong integrated finance, our health care network and our technology platform. We believe we can offer the best experience, best service and best protection through your retirement.”

With these three ingredients, the company has formed a health care ecosystem providing three levels of elderly care: a three-in-one service model of “insurance + home-based elderly care,” “insurance + high-end elderly care” and “insurance + health management.”

The development of China’s new “silver economy” in the form of its burgeoning health care industry represents the formation of an emerging strategic pillar industry. The aim is to promote and support healthy aging. Ping An is seeking to set new standards in this new sector to promote healthy and enjoyable retirement.

This content was produced by the Wall Street Journal Custom Content, in Collaboration with Ping An Group. Click here to read the original post.