Insights, Events and Videos

The Future of Financial Services in China

The financial services industry in China is undergoing a sea change, moving beyond the brick-and-mortar branch staffed by a battalion of sales reps to a leaner, more responsive, digital-first solution. Whereas customers used to be OK with going to the bank for a savings account and going to another office for health insurance, Chinese customers today want all their financial services conveniently in one place.

To stay ahead of this change, Ping An is pioneering a new integrated finance model—a one-stop shop that makes it easy for customers to get the financial services they need. Of course, that shop isn’t as straightforward as building an online supermarket. Ping An’s innovative digital “ecosystem” approach entices China’s nearly 1 billion[1] internet users with customized services, while giving the company the opportunity to cross-sell its multiple offerings.

“It is not like the traditional way of opening an online bank or offering online insurance services. By integrating finance with ecosystems, we can access customers in a less intrusive way and explore and satisfy their needs,” Peter Ma, chairman and founder of Ping An Insurance Group, said at the company’s annual shareholders meeting.

Creating Ecosystems

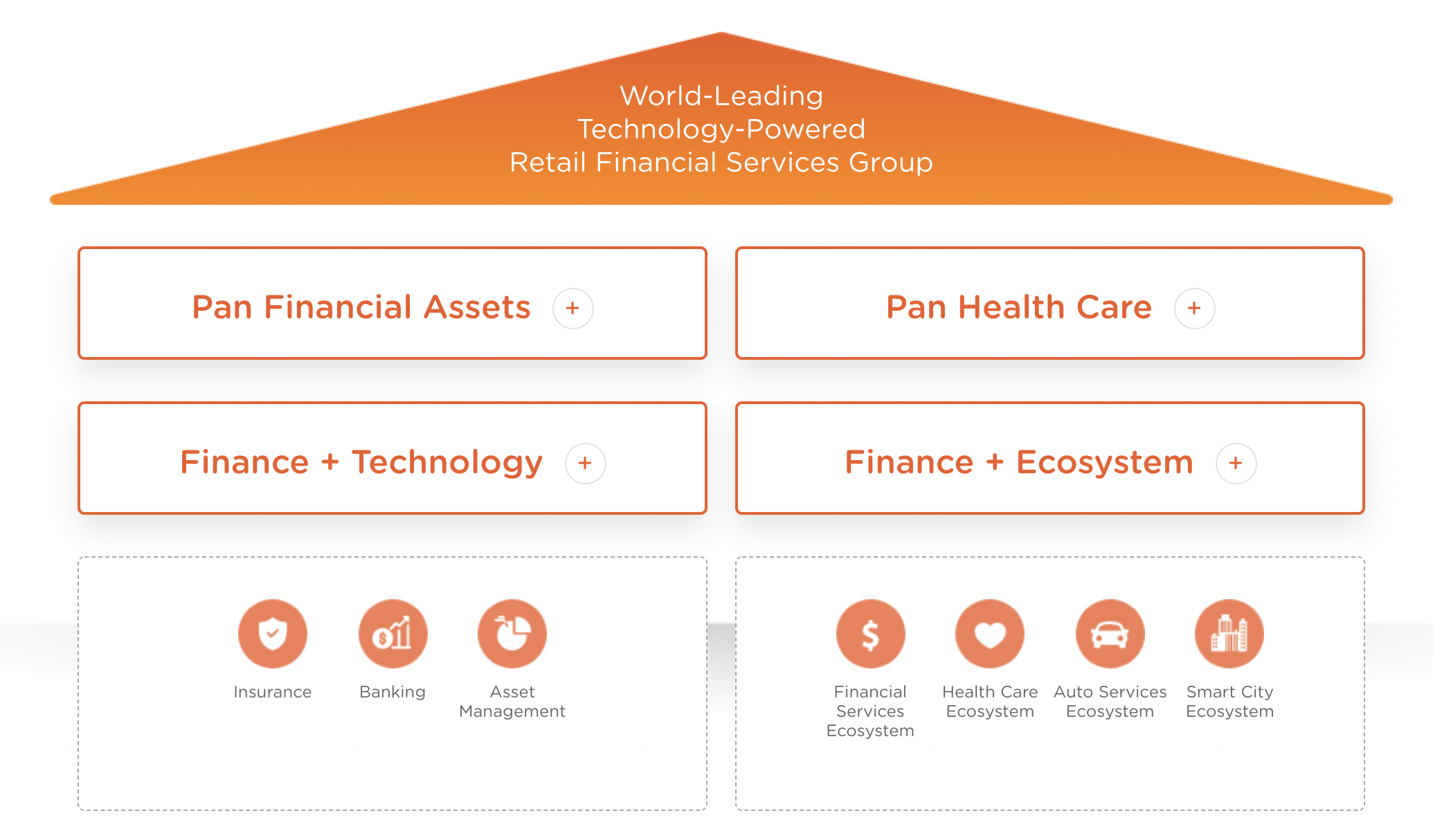

Though often seen simply as an insurance company, Ping An is an integrated financial services company with a vast range of products and services that encompasses banking, asset management, healthcare and more. The company is now leveraging its breadth of products and services to create highly integrated ecosystems.

Ping An's pioneering ecosystem model rethinks the future of insurance and financial services.

Ping An has made significant investments to develop four major ecosystems: financial services, healthcare, auto services and smart city services. These give existing and prospective customers touchpoints with various financial products during opportune times—a strategy known as scenario-based marketing.

This approach upturns the usual process. Instead of customers needing to look for a credit card, car loan or life insurance product that suits their particular needs, Ping An can reach out to interested customers in life scenarios where such a product would be useful and relevant.

Ping An’s integrated financial model has already proven its effectiveness in an impressive increase in customer conversions. Not only that, but customers who use the services available through the various ecosystems are more likely to own or subscribe to multiple products. In the first half of 2021, more than 38% of Ping An’s customers have contracts with several of the company’s subsidiaries. On average, customers using the services in the digital ecosystems have 2.9 contracts, compared to an average of 1.2 contracts for customers who did not use the services. Average revenue per user is also higher for customers using the ecosystem services, at 34,000 yuan[3] ($5,288), compared to 9,000 yuan ($1,399) for those who did not.

And the opportunity for continued growth is huge. As of the end of September, Ping An had more than 225 million customers, but these digital ecosystems contain a pool of 634 million [2] internet users. There is enormous potential to convert those internet users into customers. In the first half nine months of 2021, more than a third of Ping An’s 25 million new customers were sourced from the ecosystems.

Ping An believes its ecosystems will help diversify the business and keep revenue steady throughout various business cycles. For instance, life insurance has seen a decline in profits so far in 2021 due to reforms, but the company’s technology business has seen profit growth of 59% while its banking unit recorded 30% growth in profit.

Ping An has backed up its strategy with heavy investment in technology to improve efficiency, reduce costs and lessen risk. The company has been investing 1% of annual revenue into research and development in artificial intelligence, intelligent cognition, blockchain, cloud computing and other digital tools. So far, Ping An has filed more than 36,800 tech-related patents.

Injecting Financial Services Into the Ecosystems

As part of its ecosystem approach, Ping An acquired a majority stake in Autohome, China’s largest online car sales portal. In addition to sales of actual cars, the platform, which receives more than 44 million daily visits[4] on average, features original content on both new and used cars to help consumers compare various models.

Ping An sees the opportunity to convert Autohome users into Ping An customers for various financial services products, from financing to insurance. For instance, a consumer who buys a car through Autohome could both finance the purchase and buy car insurance through Ping An.

Through an integrated auto services ecosystem, Ping An can empower, enable and connect car owners and services.

By nurturing and growing online portals, Ping An is pioneering a more organic way to interact with customers. In addition to Autohome, the company runs Ping An Good Doctor, China’s largest online healthcare services platform with 400 million registered users. Its smart city platforms serve more than 130 million people in 160 cities, providing a mix of services that range from public health management to bill payment. Combined, these ecosystems provide a rich database of users and information that Ping An can use to build out new services and products.

While it’s still early days for Ping An’s forward-looking ecosystem strategy, the results have been promising thus far. The company is confident it will be the way of the future.

[1] The Chinese Internet Network Information Center (CNNIC), 2021

To learn more about the The Wall Street Journal Custom series, please read here

Article 2: Integrated Healthcare Model in China

Article 3: Changing the Face of Insurance