Insights, Events and Videos

Market turmoil, geopolitical tensions and pandemic-driven uncertainty all provide more rather than fewer reasons to look at China as the next big investment opportunity.

For the global investor, it may hardly seem an auspicious time to consider a portfolio pivot to China. Uncertainty is the new normal everywhere, and China in particular faces “decouping” concerns that may exacerbate risk.

The truth is China’s moment as a foreign investment destination has arrived. A wealth of opportunity is opening up as China modernises its capital markets to power the next phase of its economic ascent with global investment.

“Even as global tensions rise, China has made a commitment to open up to global investors,” says Chi Kit Chai, CIO at Ping An of China Asset Management (Hong Kong). “It’s important to grasp that China understands this is the best way to grow the country.”

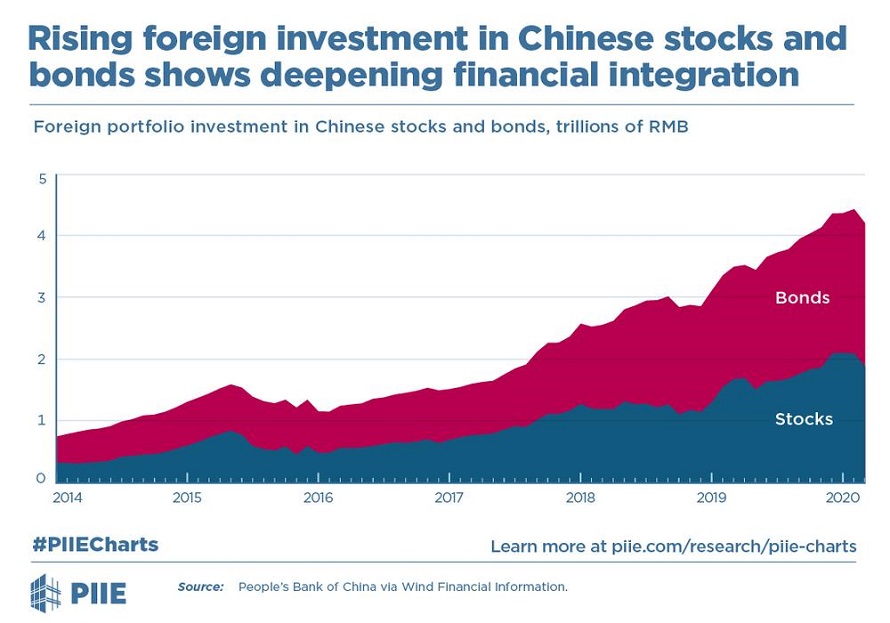

From "Rising foreign investment in Chinese stocks and bonds shows deepening financial integration," by N. R. Lardy and T. Huang, 2002, © 2020 PIIE. Reprinted with permission.

Global players are taking heed. Overseas demand for Chinese assets has hit a record high(1), with foreign holdings of Chinese bonds and equities topping Rmb1trn (nearly $150bn) through August. China’s strong Covid-19 rebound is a key factor. China posted 4.9 per cent GDP growth in the third quarter, and the IMF(2)projects China will be the only major economy to expand in 2020, with an estimated 1.9 per cent expansion.

The impressive growth numbers are just a small part of the picture. According to Chai, global investors are being attracted by “a confluence of factors” – including diversification benefits, higher yields, green investment opportunities and growing tech leadership.

Perfect storm of opportunity

Despite wrenching pandemic dislocation, economic stars have aligned to make 2020 the breakthrough year for foreign investment in China.

To begin with, China opened floodgates to global capital in May, with the removal of quotas on foreign investors in domestic markets. Qualified foreign institutional investors now face zero curbs to injecting funds into China’s bond and stock markets – a landmark deregulation that capped years of easing foreign investment restrictions.

According to Peter Reynolds, head of China at consultancy Oliver Wyman, the reforms represent a genuine movement to “bring global best practices into China”, fostering a new paradigm of Chinese economic development.

“China recognises that moving away from a bank-driven financing model to more efficient blended capital markets requires professionalization of the system,” says Reynolds. “And the fast-track to professionalization is to allow opportunities for foreign firms and foreign investors to come into China.”

"China recognises that moving away from a bank-driven financing model to more efficient blended capital markets requires professionalization of the system."

Peter Reynolds, Head of China, Oliver Wyman

These reforms converge with superior yields to power today’s historic capital inflows. With global interest rates close to zero – and negative in many developed countries – China has held its one-year loan prime rate at 3.85 per cent(3), a powerful incentive for buying Chinese debt.

China also represents diversification appeal amid Covid uncertainty. And as it leads major economies in pandemic recovery, it has become an oasis of economic stability and growth. According to Chai, China is unique among major economies in enjoying both a buoyant domestic economy – as expendable income is spent at home rather than abroad – and surging exports – as reopened industries step in to support global supply chains.

These factors add up to a bullish narrative in which the most nimble investors reap the greatest benefits. “There are risks associated with jumping [into China],” according to a Boston Consulting Group report(4). “But, given the upside of first-mover advantage, the risks associated with hesitating increase with each passing month.”

A long horizon investment narrative

China is a historic investment opportunity that will gather strength for decades. Unlike saturated markets in the West, Chai says, China still has massive capacity to absorb foreign capital. It sits on the world’s second-biggest equity market and second-biggest bond market. And Beijing is fast lifting investment restrictions in its core A-shares market, proof that it wants global players to be an integral part of the growth narrative.

Meanwhile, China has demonstrated commitment to drive its economic rise in an eco-friendly way. That means its green bond market will represent a significant opportunity for foreign investors seeking a combination of stability, ESG impact and competitive yield.

Growing tech prowess is another driver of the long-term Chinese investment narrative. Importantly, China is taking innovation leadership in critical enablers of the Covid and post-Covid world. These include mobile payments, digital communications, e-commerce and digital healthcare.

“From 5G digital infrastructure to mobility solutions, China is taking the lead in fields that will be growth areas of the global economy,” says Chai. “That opens up a world of investment opportunity.”

"From 5G digital infrastructure to mobility solutions, China is taking the lead in fields that will be growth areas of the global economy."

Chi Kit Chai, CIO at Ping An of China Asset Management (Hong Kong)

A local partner to navigate China’s investment universe

BCG says it expects China’s asset management market to more than double by 2025, becoming the second largest after the US – “as the Chinese economy continues to grow and liberalise”.

For foreign investors, the spectacular growth holds a challenge within opportunity. Even with proactive measures to open up, China remains a difficult and sometimes confusing place to navigate for the global investor.

A strong local partner is needed to provide guidance on risk management, cross-border investment, regulation, deal sourcing, local resources and more. Ping An of China Asset Management (Hong Kong) offers unique resources for the international investor that leverages its role as a member of the Ping An Insurance group.

“Ping An is a financial conglomerate, and also a technology conglomerate,” says Chai. “We are embedded in every area of the economy, so we can provide unique insight.”

Ping An’s financial services include banking, insurance, brokerage and asset management. As a technology ecosystem, Ping An runs Lufax, an online financial marketplace; OneConnect, a fintech platform; and Good Doctor, a digital healthcare app.

“We have investment knowledge and expertise,” says Chai. “At the same time, we can guide clients not just from an investment standpoint, but also on future trends, from mobility to healthcare and property risk. We’re unique in being able to offer global investors a holistic view of China.”

(1) https://www.ft.com/content/4b4f1aa2-6938-473c-95cf-235478a45976

(4) https://on.bcg.com/34MIruO

This content was produced by the commercial department of the Financial Times, in collaboration with Ping An of China Asset Management(Hong Kong).