Insights, Events and Videos

Ping An Group 2023: A Year of Strategic Development and Sustained Growth

In 2023, Ping An Group celebrated a year of significant achievements as the global economy recovered from the pandemic. The company's “integrated finance + healthcare” model proved highly successful, recording a solid operating profit of RMB112.48 billion by the end of September, along with a strong annualized operating return on equity (ROE) of 16.7%. The life and health insurance businesses saw a 40.9% increase in new business value, which soared to RMB33.574 billion.

Sustainability remained at the forefront of Ping An's strategy. The Group retained its A rating in the MSCI-ESG ratings for a second year, securing its first-place ranking in multi-line insurance and brokerage industry category across the Asia-Pacific region. The Group was also recognized by seven awards from Institutional Investor Magazine and was named the Most Honoured Company* for the 10th consecutive year. Ping An was also the only insurance firm to be ranked in the top 1% of the S&P Global 2023 Sustainability Yearbook (China Edition), among nearly 1,600 Chinese enterprises.

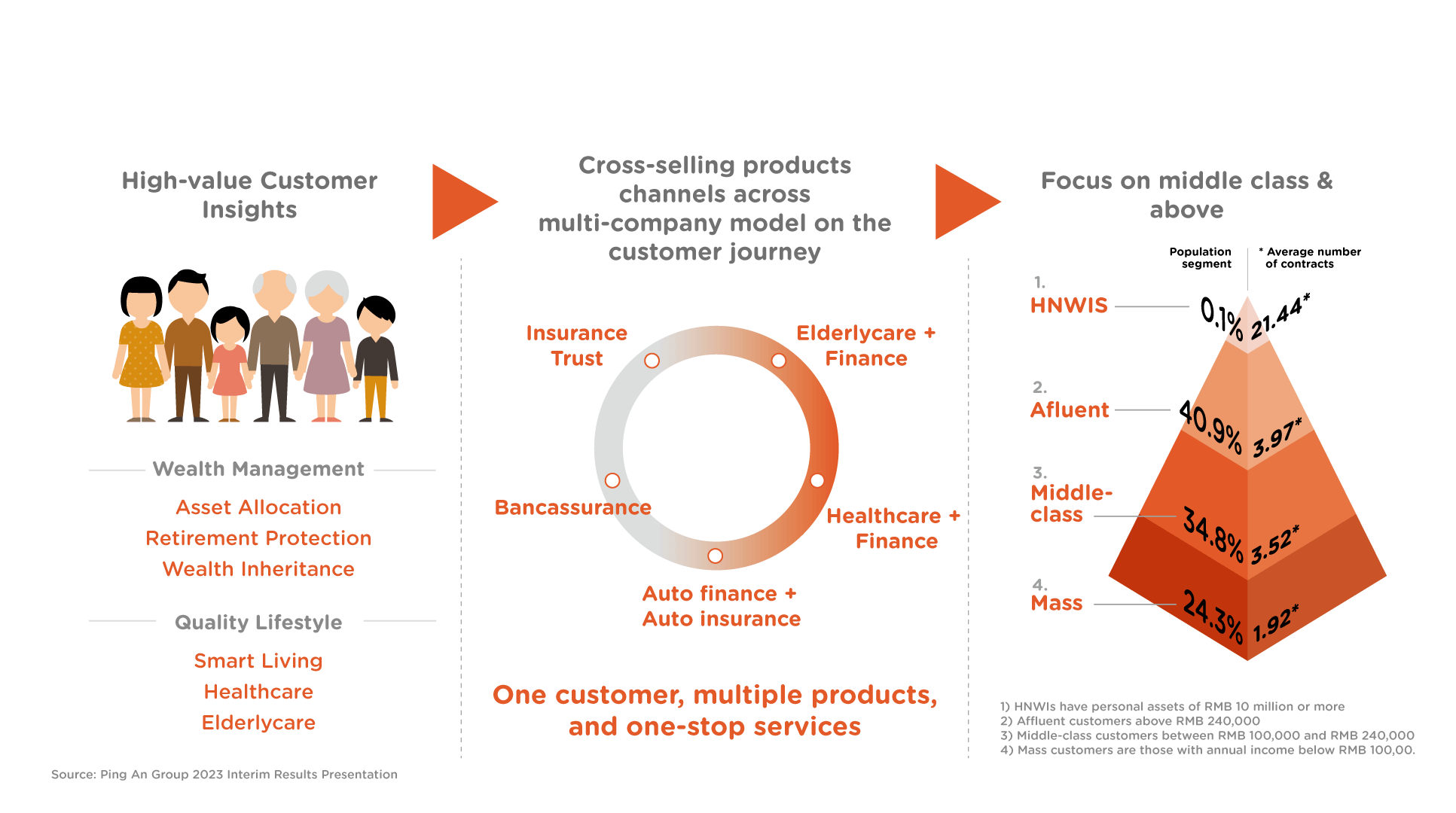

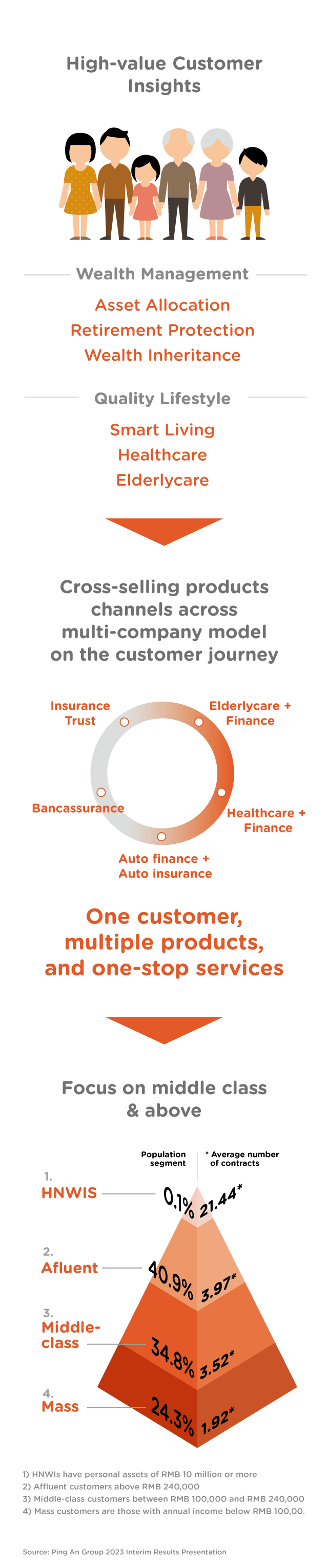

Leveraging the integrated finance + healthcare model

Ping An continued to redefine financial services, seamlessly integrating offerings including insurance, banking, securities, and investment to meet customers' financial, healthcare and elderly care needs. The Group's technology-driven approach, leveraging artificial intelligence (AI) and big data, increased insurance claims efficiency: life insurance claims can be processed in just 10 minutes and property insurance vehicle assessments completed within 30 minutes.

Ping An’s healthcare ecosystem expanded with 17 health management centres and extensive cooperation with every 3A hospital in China. The network now includes nearly 54,000 in-house and contracted doctors and 228,000 pharmacies. New initiatives, such as the Home-based Elderly Care Alliance and Ping An Carefree Nursing, were introduced to support standardization in the rehabilitation nursing industry.

By September 2023, nearly 64% of Ping An's 230 million financial services customers were also actively engaged with services from the health ecosystem, with an average of 3.42 contracts with Ping An and RMB56,100 assets under management (AUM) per customer. These were significantly higher levels compared to customers who were not using the healthcare ecosystem services.

Driving the real economy with strategic investments

Ping An's commitment to supporting the real economy was evident in its over RMB8 trillion investment in national strategic initiatives such as the Belt and Road Initiative and the Guangdong-Hong Kong-Macao Greater Bay Area development. The Group provided insurance for key national projects, including major aerospace and aircraft manufacturing achievements. By December 2023, Ping An Property & Casualty had offered significant risk protection for numerous domestic and international projects, playing an integral supporting role in critical infrastructure and development.

Cultivating sustainable development

In its journey toward a greener future, Ping An had a green insurance premium income of RMB26.28 billion by September 2023, with green loans and insurance green investments of RMB136 billion and RMB132 billion respectively. The company pioneered the first carbon account system for its employees and established a RMB10 million Mangrove Ecological Protection Charity Trust, offering innovative mangrove carbon sink index insurance and supporting mangrove conservation.

Ping An also made substantial contributions to rural revitalization. It provided vital aid and agricultural loans and engaged in initiatives that have directly benefited millions of villagers, establishing a solid foundation for community development and economic activation.

Looking forward with vision and resolve

As Ping An enters 2024, it does so with a commitment to aligning with national strategies, focusing on people, driving innovation, and maximizing both customer and company value. The year 2023 stands as a testament to the Group's strong growth trajectory and leading role in integrated finance. It has established a strong foundation for a future for finance to serve as a powerful enabler for customers and society at large to enhance quality of life.

*Ranking comes from Institutional Investor’s 2023 Asia (ex-Japan) Executive Team survey among 1,600 companies.