Insights, Events and Videos

China is undertaking sweeping reforms to enhance its pension system, prioritizing the long-term financial well-being of its rapidly aging population amid unprecedented demographic challenges. Ongoing reforms present a significant opportunity for investors—KPMG China and the Asia Securities Industry & Financial Markets Association (ASIFMA) project a total pension market of 28 trillion yuan ($3.95 trillion) and a private pension market of 7 trillion yuan ($988.35 billion) by 2030.1

The Demographic Challenge of an Aging Population

While for centuries, China had the world’s largest population, it is now experiencing a demographic shift. Within the next two decades, the country’s elderly population is predicted to outnumber the entire population of the United States. By 2040, an estimated 402 million people in China, making up 28% of the population, will be over 60, exceeding the projected 379 million in the U.S.2

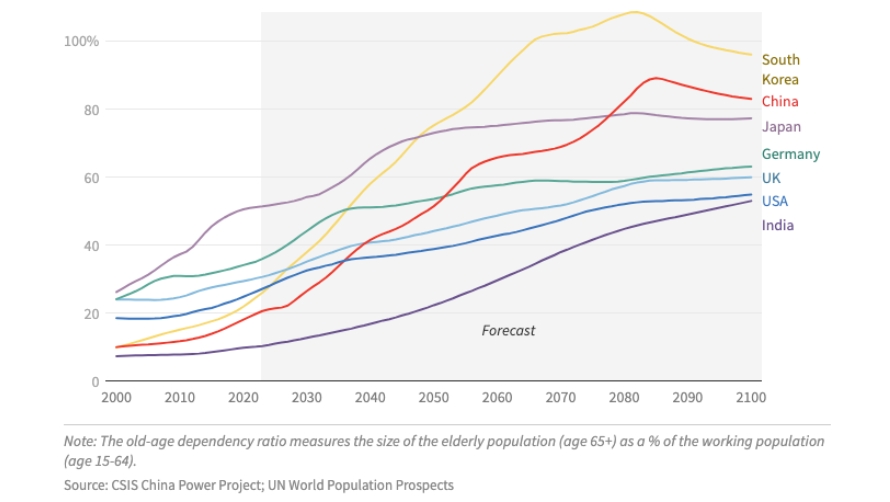

The age-dependency ratio (% of working-age population) is forecast to keep increasing over the next few decades. Paired with a shrinking labor force and rapidly growing retiree base, this places greater strain on local economies and public resources.3

Unlike most developed countries, China is growing old quickly before becoming rich. Data shows that it took 115 years for France to transition to an aging society, 80 years for the U,K. and 60 years for the U.S. By contrast, China took only 18 years (from 1981 to 1999).

When the U.S., Japan, South Korea and Singapore entered the aging population stage, their per capita GDP exceeded $10,000. But when China crossed the threshold of an aging society in 2000, its average per capita GDP was approximately $3,976—significantly lower than the world average of $7,446.4 This economic gap presents several challenges, including unsustainable pension funding, low retirement replacement ratios and overstretched health care resources.

In September 2024, Beijing unveiled a plan to gradually raise the retirement age for the first time since the 1950s.3 Starting in 2025, men’s retirement age will rise from 60 to 63, while women’s retirement age will rise from 50 to 55 in blue-collar jobs and from 55 to 58 in white-collar jobs. Additionally, starting in 2030, employees will be required to contribute to social security for 20 years—instead of the current 15 years—to qualify for pensions.

From the ‘Iron Rice Bowl’ to Individual Choice

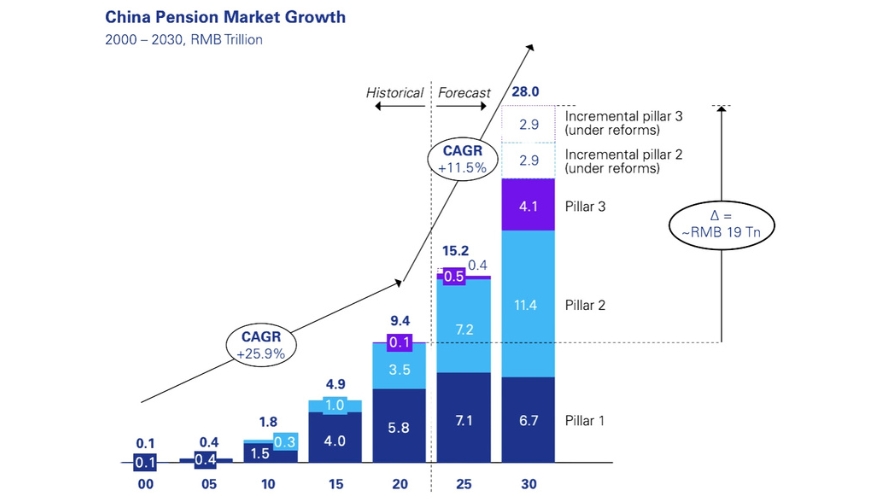

China’s three-pillar pension system, valued at 15.54 trillion yuan ($2.19 trillion) as of 2022,5 is facing significant structural challenges. Pillar 1, a mandatory state pension system that provides basic coverage, may run out by 2035; Pillar 2, accounting for company and occupational annuities, remains limited in coverage. However, the nascent Pillar 3, introduced in 2022 as a voluntary private pension system, shows tremendous potential for growth. Already, 60 million residents have opened individual pension accounts, and the private pension market is projected to reach 7 trillion yuan ($985.67 billion) by 2030.

The implementation of private pension programs has boosted residents’ willingness to make investment plans. In June 2024, the ministry announced that over 60 million residents had opened individual accounts. Middle- to high-income earners aged between 31 and 40 have shown the strongest interest in opening such accounts to purchase relevant products to prepare for their retirement.8 Furthermore, EY projections indicate that more than a billion Chinese are expected to initiate individual pension savings in the future and that the customer segment will move to a broader demographic of 30 to 50 years old.9

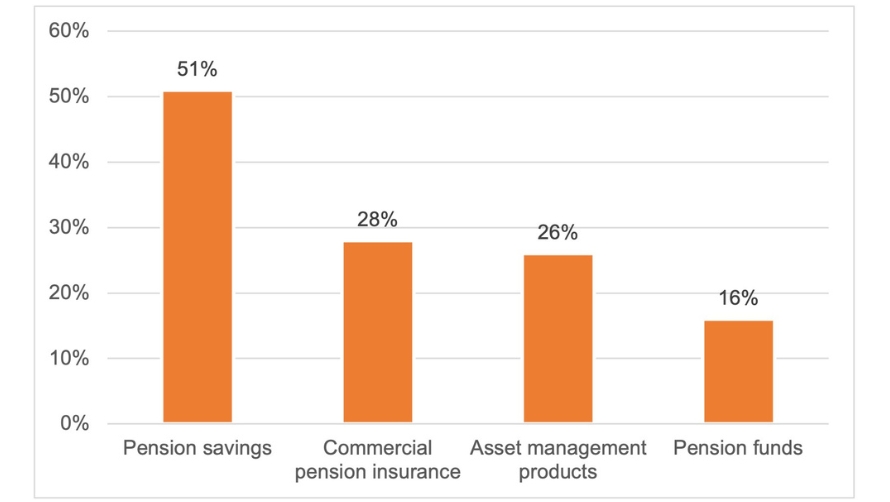

According to a recent survey conducted by the China Aging Finance Forum, a think tank providing independent research to Chinese policymakers, 85% of the respondents aged 30 to 39 have included pension planning in their investment and asset allocation plans. Among multiple categories of pension financial products, 51% of respondents favored pension savings deposits, 28% would purchase market-based commercial pension insurance, 26% were willing to opt for asset management products and 16% planned to purchase pension funds.4

A joint report by KPMG and ASIFMA shows that China’s pension market expanded from 100 billion to 9.4 trillion yuan ($14.08 billion to $1.32 trillion) between 2000 and 2020 and is estimated to keep increasing to 28 trillion yuan ($3.94 trillion) by 2030, while the private pension market could potentially grow to 7 trillion yuan ($985.67 billion).

Early Movers See the First Rewards

Providing fertile ground for key players to develop and test different strategies, this new market is attracting both domestic and international service providers, inviting insurers, annuity companies and banks to compete on a level playing field. Ping An Group—a China-based integrated finance conglomerate with operations in insurance, banking, investments, health care and senior-care sectors—is seizing the opportunity to serve 236 million customers through multiple subsidiaries.

“China’s growing senior population is bringing tremendous business opportunities to the financial services industry.”says Michael Guo, Ping An Group’s co-CEO.

Meanwhile, Ping An Bank, which offers 149 specialized financial products tailored to seniors, had acquired 1.1 million clients opening individual pension accounts by the first quarter of 2024. Ping An Fund has also introduced five individual pension products, consisting of four target-date funds and one target risk fund, with total managed assets surpassing 1.3 billion yuan ($183 million) as of June 2024.

“As average life expectancy increases, people will attach greater importance to pensions and start planning earlier,” says Guo. “With a base of 236 million retail customers, Ping An understands the needs of end customers.”

References

- https://assets.kpmg.com/content/dam/kpmg/cn/pdf/en/2023/06/china-pensions-reform.pdf

- https://foreignpolicy.com/2023/06/29/china-pensions-aging-demographics-economy/

- https://chinapower.csis.org/china-demographics-challenges/

- https://cohd.cau.edu.cn/module/download/downfile.jsp?classid=0&filename=d012dcf0ad204d23a3fd6f9674d5dc55.pdf

- https://www.sohu.com/a/785881025_603349

- https://www.asianinvestor.net/article/prudential-calls-for-more-incentives-to-boost-china-private-pension-industry/495408

- https://www.soa.org/4a56e4/globalassets/assets/files/resources/research-report/2023/insurers-developing-third-pillar.pdf

- https://english.www.gov.cn/archive/statistics/202406/08/content_WS6664082ec6d0868f4e8e7f01.html

- https://www.ey.com/en_cn/strategy/a-new-era-of-chinas-pension-system