Insights, Events and Videos

Historically, both life and health insurance companies have operated in a relatively passive manner. When customers became ill, suffered injuries or passed away, the insurance provider would be informed and would process the claim and distribute the policy benefits accordingly. To reduce risk, insurers use the underwriting process to determine how risky each policy applicant is based on their health, lifestyle, hobbies and other personal habits. The risk level associated with each policyholder may affect how much the policy costs.

Now, some insurance companies no longer limit themselves to risk assessment and claim payment. Instead, they actively engage with customers to help them maintain optimal health and longevity. The healthier the policyholder, the less likely they are to make claims on the insurance provider.

Prevention Before Compensation

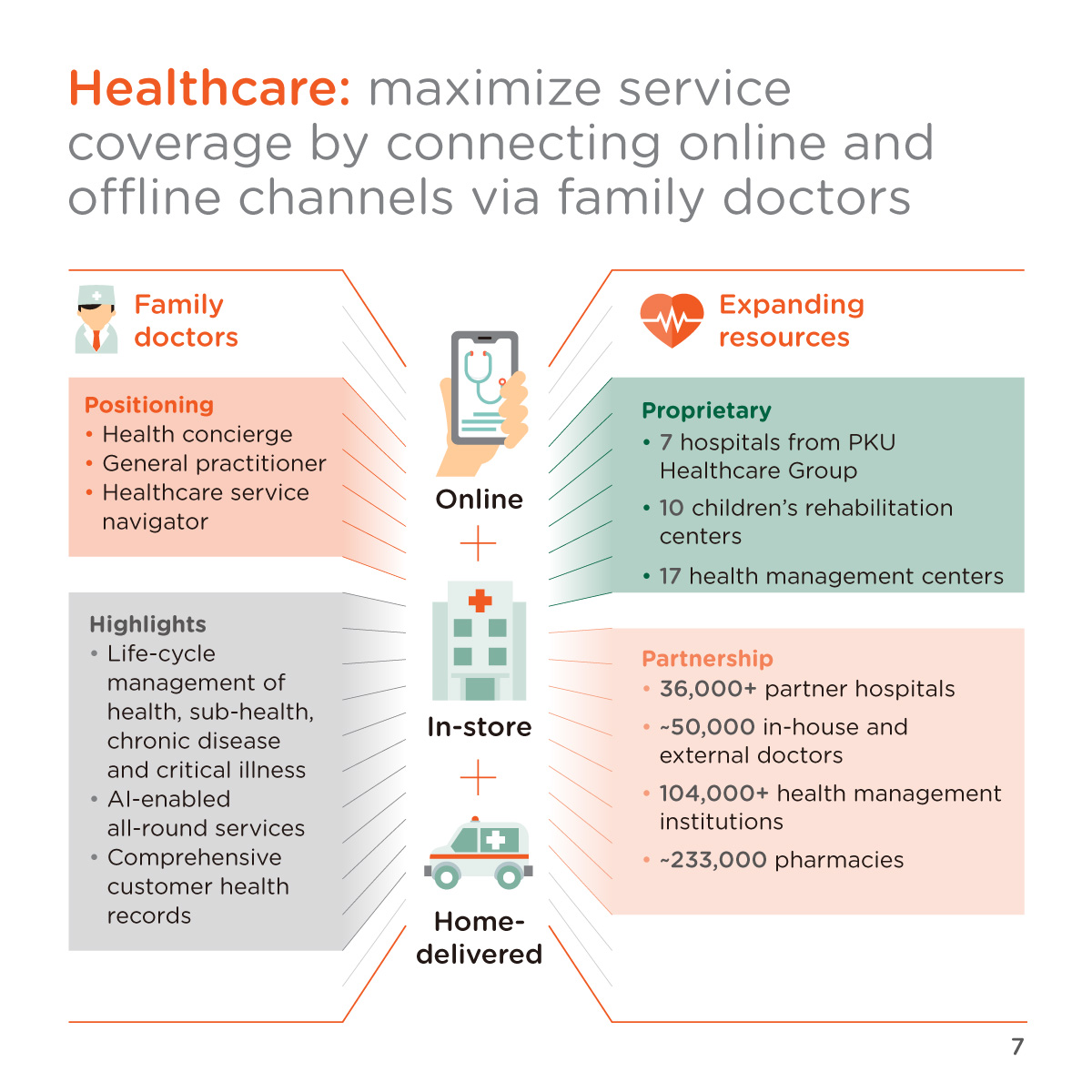

Ping An Group, China’s largest insurance company in terms of market capitalization and revenue, has unveiled a groundbreaking protection and prevention model in the country. This approach involves offering policyholders an integrated healthcare service combining an online platform with offline solutions.

As part of the initiative, Ping An Family Doctor (PAFD), a service launched by the group’s health unit in 2022, offers customers a comprehensive health management plan including illness prevention, chronic disease mitigation and access to offline professional medical care. Through this program, customers benefit from a holistic approach to their wellbeing.

Since the launch of PAFD, nearly 13 million members have registered and benefited from the services—and upon registration, customers can upload their physical examination results to the platform. The AI-powered system promptly scans the results, detects potential health risks and provides tailored health management plans accordingly, enabling prompt action to be taken before conditions become problematic. For patients with chronic diseases, the PAFD keeps track of their health via wearable devices and sends out warnings in real time when necessary.

The platform also offers a 21-day lifestyle management program to assist patients in managing diet, exercise, sleep and other essential aspects of their wellbeing. For individuals with specific medical conditions, the PAFD offers 24/7 prehospitalization consultations, recommendations for certified doctors and hospitals, assistance with appointment registrations, dedicated nursing care during hospitalization, personalized “recovery guides” tailored to individual needs and follow-up visits after discharge. On the platform, 50,000 doctors are available to provide daily remote medical diagnosis and treatment with the aid of advanced technologies.

This program is supported by leading medical technology. Over the years, Ping An has built five major databases, including repositories for diseases, prescription treatments, medical products, medical resources and personal health. These databases constitute a leading global knowledge graph, or organization of data from multiple sources, in the field of healthcare. Based on this foundation, Ping An has developed innovative multimodal medical models and 12 AI business models.

A group of medical professionals from internal or external institutions provide offline medical services: Ping An operates seven hospitals, 17 proprietary health management centers and ten children’s rehabilitation centers. Additionally, the insurer has partnered with more than 36,000 hospitals, approximately 233,000 pharmacies and over 104,000 healthcare management institutions.

Synergizing Healthcare and Insurance

Ping An has been building its health and senior care ecosystem since 2014, and invests up to 10 billion yuan ($1.37 billion) each year in R&D to support its development. Data shows that in the first half of 2024, the company’s life and health insurance sectors achieved stable growth, with new business value amounting to 22.32 billion yuan ($3.14 billion)—a year-on-year increase of 11%. Policyholders entitled to Ping An’s health and senior care services accounted for over 68% of this expansion. And in the first half of 2024, 16 million life insurance customers benefitted from the Group’s health and senior care services, with 70% of new enrollers utilizing its health management solutions.

“We are committed to assisting our customers in achieving longer lives while offering them worry-free, time-saving, cost-saving and healthier life experiences,” said Michael Guo, co-CEO of Ping An, during the World Economic Forum’s Annual Meeting of the New Champions, known as “Summer Davos,” in June 2024.

The management of customer health and early treatment of illnesses offers policyholders a more proactive and convenient method of managing their health, allowing them to improve their quality of life while reducing healthcare expenditures. Insurance companies have the potential to greatly reduce the number of payouts that may arise from delaying the treatment of diseases, presenting an encouraging prospect for both companies and investors.