Insights, Events and Videos

The world’s second largest economy is aging rapidly. In 2023, China had 297mn people aged 60 and over, representing 21 per cent of the total population. This number is projected to reach 487mn in 2050.

To address this demographic shift, China has introduced guidelines to actively boost the “silver economy” — essentially the system of production, distribution and consumption of goods and services aimed at older people. In a report to the national legislature, the National Development and Reform Commission recommended expanding the silver economy by cultivating more brands and guiding the sector with higher standards.

The silver economy presents new growth opportunities and encompasses numerous sectors. In 2024, the size of China's silver economy is estimated to be around Rmb7tn ($966bn), equivalent to 6 per cent of China’s GDP. By 2035, the market is projected to reach Rmb30tn, accounting for 10 per cent of GDP.

Evolving lifestyle and spending habits

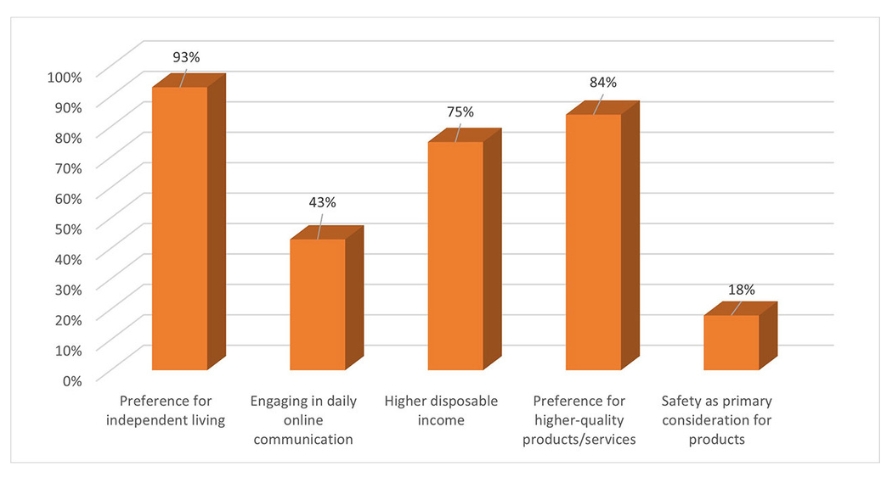

China's elderly population previously had a reputation for being thrifty, leaning towards saving money. The current generation of Chinese seniors is breaking this stereotype, however, as they emerge as one of the wealthiest in the country's history. Hong Kong Trade Development Council (HKTDC) research shows significant changes in their lifestyles and spending habits, in fact.

The overwhelming majority of the respondents (93 per cent) said that they should live independently, while 84 per cent preferred to buy high-quality products and services. More than 70 per cent reported having higher disposable income from an increase in their pensions. And nearly half of seniors actively engaged in online communication.

Opportunities in China’s silver economy

1) Personalised homecare services

The dominant senior-care model in China follows a 90-7-3 approach, where 90 per cent of seniors prefer to stay at home, 7 per cent seeks community-based care and 3 per cent opt for elderly-care institutions.

This emphasis on home-based senior care is driving the demand for personal assistance and professional nursing services, such as bathing, house cleaning and meal preparation. With varying needs and preferences among individuals, there is a high demand for personalised homecare services.

2)Technology-powered services

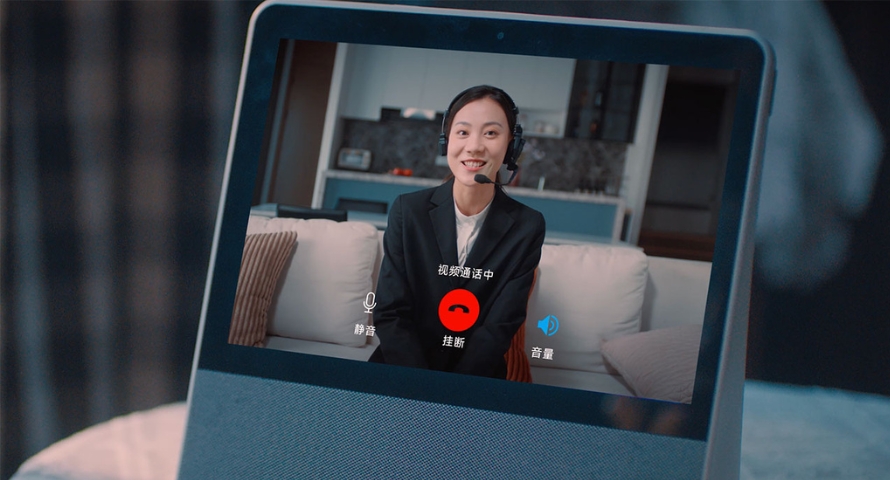

With the use of technology, seniors are able to age actively and independently. Developing tech products presents a huge opportunity for businesses.

A statement released by China’s State Council in January 2024, in fact, emphasised the significance of technology to the silver economy. The paper identifies smart products and services that are proving essential for elderly care, such as wearable devices, self-service health-testing equipment and telemedicine solutions.

3) Integrated elderly care and medical services

China’s seniors have two main areas of consumption: daily needs (39 per cent) and healthcare-related expenses (41 per cent).7

Currently, there is a large gap in the demand for medical-care services for the elderly. The government is encouraging medical institutions to improve chronic disease prevention, rehabilitation and nursing care for them. 8

4) Elderly products and lifestyle needs

Higher-quality products and healthier lifestyles are key to Chinese seniors’ spending habits, covering travel assistance, elderly specific education, nutritional supplements, and so on.

Holistic solution: One-stop services empower seniors at home

Ping An Group, China’s largest insurer by market capitalisation, sees massive potential in leveraging technology to integrate these subsets of the market.

In 2021, the insurer introduced a home-based senior-care service platform that integrates intelligent solutions, online/offline medical services and lifestyle offerings. Essentially, Ping An selects service providers and centralises service procurement across different cities in China, setting unified service standards and monitoring service delivery to ensure customers get the highest quality services at the most competitive price.

One prime example of an intelligent solution is a smart monitoring system that tracks vital signs such as blood sugar, blood pressure, heart rate, breathing rate and blood oxygen level, as well as 13 behavioural risks — including accidental falls, sleep duration and daily exercise — and nine real-time environmental risks, such as air pollution, gas leaks and excessive smoke concentration. When the system detects abnormalities, it issues a warning to an online assistant who can then respond and notify medical professionals if necessary.

With a flagship medical team of 50,000 doctors, Ping An offers round-the-clock online medical consultation and treatment. As to offline resources, the insurer partners with more than 36,000 hospitals, approximately 231,000 pharmacies and more than 100,000 healthcare management institutions to provide comprehensive medical and health services.

As well as covering healthcare, the platform brings together specialised providers offering more than 600 lifestyle services for elders, such as beauty, dressing, travel, catering, nutrition consultation, finance advisory and entertainment.

As a vital component of Ping An’s health and senior-care ecosystem, the home-based senior-care service platform is currently available in 54 cities and has benefited 80,000 customers, allowing them to enjoy multiple professional services without leaving home.

In recent years, in fact, the health and senior-care ecosystem has become a growth driver for Ping An. As of the end of 2023, nearly 64 per cent of its 232mn customers utilised health and senior-care services. Core business Life & Health new business value (NBV) experienced 36 per cent year-on-year growth, reaching Rmb39,262mn ($5,421mn) in 2023. Notably, over 70 per cent of the NBV was contributed by customers benefiting from the health and senior-care ecosystem.