Insights, Events and Videos

Insurance companies are businesses that manage both assets and liabilities, generating profits by effectively matching these two elements. When insurance companies sell policies to customers, they incur liabilities, meaning they have payment obligations to fulfill. By investing the collected premiums to generate returns, insurers can earn a profit if the returns cover the cost of the liabilities and ensure timely payouts.

In other words, the closer an insurance company’s assets and liabilities match in terms of cost, returns, and duration structure, the greater the potential for profit.

Insurance funds typically have long-term attributes. However, due to a lack of high-yield long-term assets in China, it is challenging to meet the annual allocation needs of more than RMB2 trillion and reinvesting matured funds. This results in a common industry issue: short-term allocation for long-term money. Insurance companies are also challenged to maintain stable long-term investment returns amid interest rate and equity market fluctuations and interest spread risk.

Data from the Insurance Asset Management Association of China highlights a significant duration mismatch: the average liability duration in the domestic life insurance industry exceeds 12 years, while the average asset duration is only around six years. This represents a challenge for insurers to maintain balance sheet stability and meet their financial obligations over time.

The declining interest rate environment and the volatile stock market are not helping insurers in China, putting pressure on the rate of return from investing the insurance funds. This highlights the need for insurance companies to devise effective allocation strategies that deliver stable long-term returns.

According to the National Financial Regulatory Administration, by the end of 2022, fund utilization of the insurance industry reached RMB25.35 trillion, representing a year-on-year increase of 9.15%. In the same year, these insurance funds achieved an annualized comprehensive investment yield of 1.83%, the lowest since 2011. In 2023, the industry’s fund utilization grew 11.05% year-on-year to reach RMB28.16 trillion, while comprehensive investment yield improved to 3.22%, which was the second lowest since 2011.

Effective asset-liability management

As of December 31, 2023, Ping An’s insurance fund investment portfolio reached nearly RMB4.72 trillion, a 9.0% increase from the beginning of the year. Effectively managing such a large portfolio of insurance assets presents significant challenges.

In recent years, Ping An has continued to increase its allocation to long-duration interest rate bonds, such as government bonds and local government bonds, particularly during interest rate peaks. This strategy has gradually reduced the asset-liability duration gap from five years to within three years, a rare achievement for any insurer operating in the Chinese or global markets.

In terms of investment returns, Ping An’s insurance funds investment portfolio achieved an annualized comprehensive investment yield of 3.6% in 2023, up by 0.9 percentage points year-on-year. While Ping An may not consistently be an investment star, its average comprehensive investment yield over the past decade has been around 5.4%. This demonstrates the effectiveness of Ping An’s long-term value investing approach across macroeconomic cycles.

Unique “Double Barbell” balanced allocation

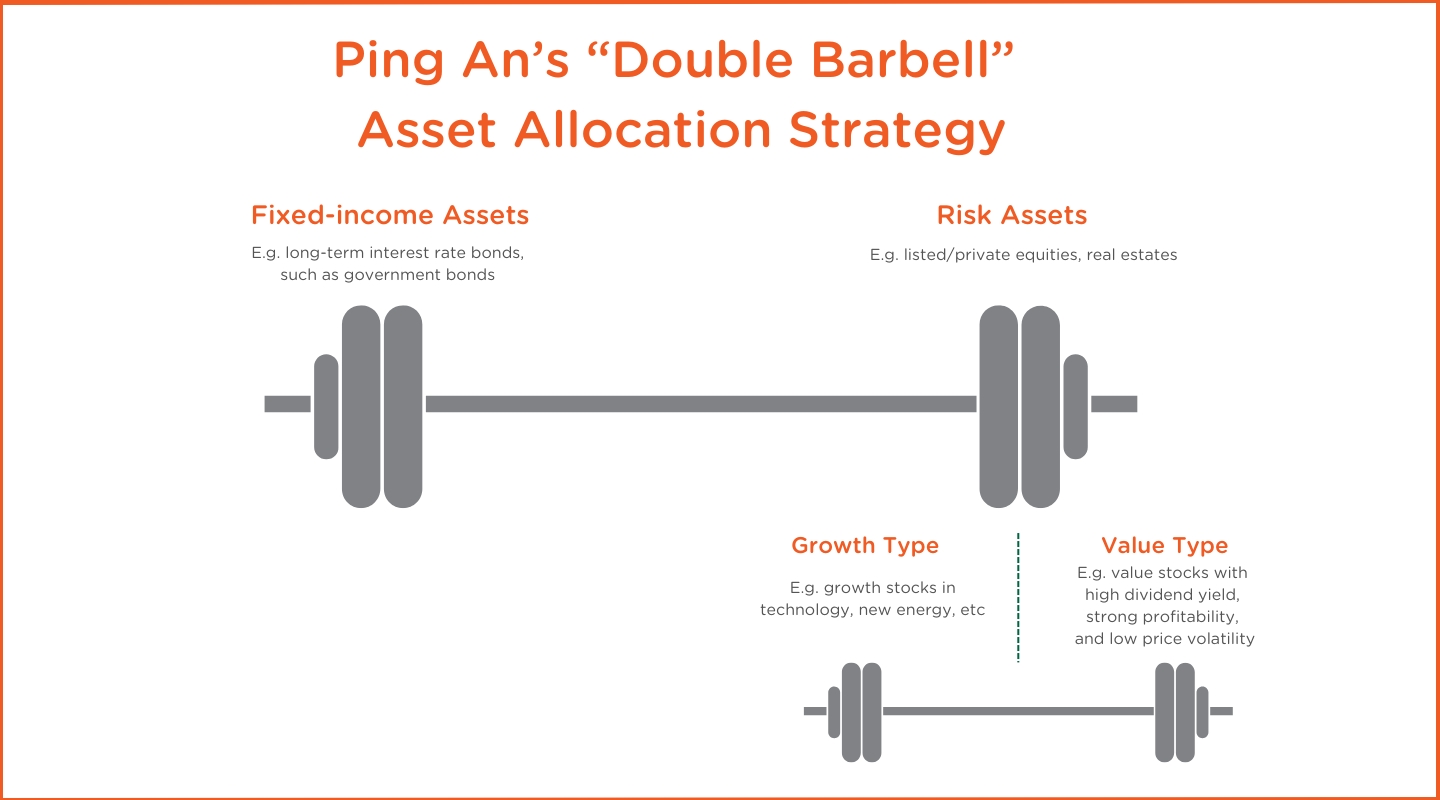

Ping An’s “double barbell” strategy, encompassing both a “big barbell” and a “small barbell,” forms a balanced asset allocation structure for its insurance funds.

One end of the “big barbell” consists of a large number of long-duration interest rate bonds, including government bonds and local government bonds. The other end consists of risk assets, such as equities, real estate, and private equity. As the insurance company holding the most long-duration interest rate bonds, Ping An must allocate risk assets accordingly, to create a balanced structure within the barbell.

Within the risk asset end of the big barbell, there is a “small barbell”. One end consists of value stocks, which are characterized by high dividends, strong profitability, and low price volatility, making them suitable for value investing. The other end of the small barbell includes growth stocks, such as technology, healthcare, and new energy sector stocks, creating a balanced approach.

The fixed-income assets on one end of the “big barbell” ensure stable returns for the Group, while the risk assets on the other end significantly enhance overall returns. As of December 31, 2023, Ping An’s bond investments and bond funds had a book value of RMB2.85 trillion, accounting for 60.4% of the total investment amount.

Ultimately, the unique “double barbell” structure ensures stable returns while remaining adaptable in the face of market fluctuations. By balancing between equities and bonds, asset allocation can be handled with the precision required to effectively enhance returns.