Insights, Events and Videos

For many years, China has maintained one of the lowest retirement ages of any major economy.1 However, as the country confronts an ageing population and shrinking China pension budget, the next generation will need to stay in the workforce longer.

In September 2024, Beijing announced a gradual increase in the China’s retirement age for the first time since 1978.2 For women, the retirement age will rise from 50 to 55 for blue-collar jobs and from 55 to 58 for white-collar occupations. For men, the retirement age will increase from 60 to 63. These changes will take effect in January 2025, with retirement ages rising incrementally every few months over the next 15 years.

Starting from January 2030, the minimum contribution period required to access the basic China retirement pension will also gradually increase. Employees will need to contribute for 20 years by 2039, up from the current requirement of 15 years.

Pressures on China’s pension system

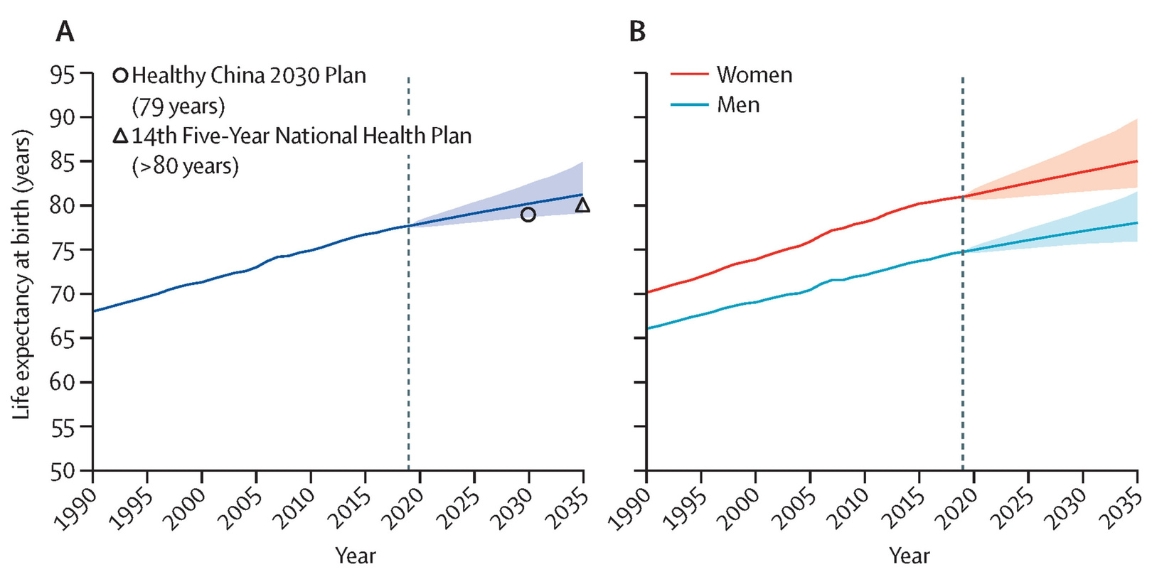

In 2022, China recorded its first annual population decline since the early 1960s after six consecutive years of falling birth rates. The United Nations projects that China’s population will drop from 1.42bn in 2022 to 1.31bn by 2050, potentially falling below 800mn by 2100.34 Meanwhile, life expectancy, which stood at 77.7 years in 2019, is expected to reach 81.3 years by 2035.5

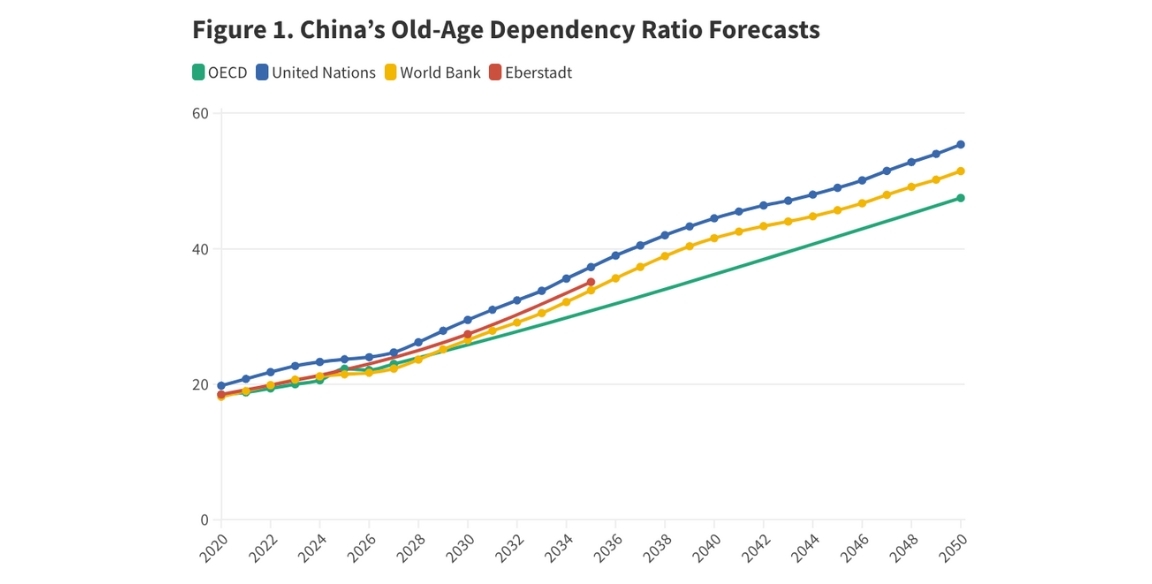

The demographic challenge extends beyond a shrinking population and rising life expectancy. China's old-age dependency ratio – measuring the number of retirees relative to working-age individuals – places increasing pressure on income earners to support a growing elderly population. Projections suggest that this gap will continue to widen, exacerbating the financial strain on the workforce.6

To address these demographic challenges, Beijing has been pursuing China pension reform. Part of these reforms include the introduction of a private pension scheme, making it easier for individuals to invest in a wide range of financial products.8

The China's pension system is currently structured around three pillars.

- First pillar: the mandatory basic pension system, funded by contributions from current workers. Covering around 60 per cent of the overall system and serving 1.05bn residents, it is the largest in the world.910 However, given the rapid pace of aging, this fund could be depleted by around 2035.11

- Second pillar, introduced in 2004, this includes enterprise annuities and occupational annuities. While enterprise annuities are voluntary programmes established mainly by state-owned enterprises (SOEs) or large private companies, though their voluntary nature constrains their growth potential. Occupational annuities, meanwhile, are reserved for government agencies and public sector employees, further limiting their expansion beyond this group.1213

- Third pillar: Pilot in 2018, this introduced first individual private pensions, including tax-deferred commercial pension insurance.1415 In 2022, the State Council expanded this option, allowing voluntary contributions to personal accounts invested in varied financial products. 16 By 2023, over 60mn private pension accounts had been opened across 36 cities, with more than 500 savings, insurance, and wealth management products available.17

Growth potential in China’s private pension sector

The third pillar of the China pension system represents significant growth potential. According to KPMG China and the Asia Securities Industry and Financial Markets Association (ASIFMA), the private individual pension segment could reach Rmb7tn ($990.63bn) by 2030, within a total market size of Rmb28tn ($3.96tn).1819

The expanding landscape creates opportunities for both domestic and international participants, including banks, insurance companies, wealth management firms and annuity companies.

The current financial products available in the market can be divided into three categories.20 First, there are bank-based products such as pension savings. Second, insurance-based products include tax-deferred pension, tax-deferred nursing care insurance, and market-oriented pension insurance, providing flexible retirement planning options. Lastly, fund-based products like target-risk and target-date funds offer diverse investment avenues.

As eligible investments choices expand, more opportunities are created for innovative financial solutions.21 To succeed in this growing market, financial institutions must thoroughly understand China’s regulation, localize product offerings, and strengthen distribution to reach China’s diverse customer base.

Ping An Group, one of China’s largest integrated financial conglomerates, is a major player in the China pension market. Operating across insurance, banking, health, wealth management and annuity sectors, Ping An serves 236mn retail customers with its “one customer, one account, multiple products, and one-stop services” model.

Highlights include Ping An Life, Ping An Bank, Ping An Fund, and Ping An Annuity.

Ping An Life, China’s second-largest life insurance company by premium income,offering overn 50 products across the employment lifecycle to more than 10mn senior clients aged 44 and above. From 2021 to 2023, Ping An Life added more than 700,000 senior clients who purchased new insurance policies. These senior clients’ contribution to total new policy premiums rose from 19 per cent to 34 per cent, with new premiums totalling Rmb38bn ($5.4bn).

Ping An Bank has also tailored its offerings to the senior market, launching 149 senior-specific products and over 1.1mn pension accounts opened by 2024.

Ping An Fund manages more than Rmb1.3bn ($184mn), as of June 2024, in individual pension products, including target-date and target-risk funds.

Now, Ping An Annuity, China’s first annuity company, is exploring opportunities in the third pillar of China's pension system after years of operation in the first and second pillars. By the end of 2023, Ping An Annuity held Rmb750.29bn ($106.18bn) in net assets for corporate annuities and annuity investments, with a premium income of Rmb17.33bn ($2.45bn) in 2023. The company serves 463,000 corporate clients and 124mn retail customers.

As Michael Guo, Co-CEO of Ping An, stated at the Annual Meeting of the New Champions 2024, also known as Summer Davos: “As average life expectancy increases, people will attach greater importance to pensions and start planning earlier. The demand for capital preservation and appreciation, with the goal of building a 'personal pension reserve', will become the core demand of wealth management."

“The strength of Ping An lies in its integrated finance ability,” Guo says, "Fulfilling the needs of seniors cannot be done by simply adding senior care products together. It requires a comprehensive solution that is organically combined and adjusted to meet the customised demand of seniors at different stages of their life."

Reference

- https://www.wsj.com/world/china/for-years-chinese-workers-could-retire-at-50-now-china-cant-afford-it-e7cbd405?st=NcWA3P&reflink=article_whatsapp_share https://www.morganlewis.com/pubs/2024/09/china-announces-plan-to-gradually-increase-statutory-retirement-age

- https://www.ft.com/content/56d8151e-8373-469a-bea7-11c00eb3ed16

- https://bigdatachina.csis.org/china-is-growing-old-before-it-becomes-rich-does-it-matter/

- https://www.pewresearch.org/short-reads/2022/12/05/key-facts-about-chinas-declining-population/

- https://www.thelancet.com/journals/lanpub/article/PIIS2468-2667(22)00338-3/fulltext?__cf_chl_tk=BZC3xuCuIzqOd0EAi1rrFM0Z.WmukcOmIfFinb3olr0-1727864633-0.0.1.1-5438

- https://www.thelancet.com/journals/lanpub/article/PIIS2468-2667(22)00338-3/fulltext?__cf_chl_tk=BZC3xuCuIzqOd0EAi1rrFM0Z.WmukcOmIfFinb3olr0-1727864633-0.0.1.1-5438

- https://bigdatachina.csis.org/china-is-growing-old-before-it-becomes-rich-does-it-matter/

- https://www.reuters.com/world/china/why-are-there-concerns-about-chinas-pension-system-its-population-ages-2024-01-18/

- http://www.cbimc.cn/content/2024-04/03/content_513194.html

- https://assets.kpmg.com/content/dam/kpmg/cn/pdf/en/2023/06/china-pensions-reform.pdf

- http://www.cbimc.cn/content/2024-04/03/content_513194.html

- http://www.cbimc.cn/content/2024-04/03/content_513194.html

- https://www.soa.org/4a56e4/globalassets/assets/files/resources/research-report/2023/insurers-developing-third-pillar.pdf

- https://www.soa.org/4a56e4/globalassets/assets/files/resources/research-report/2023/insurers-developing-third-pillar.pdf

- https://www.scmp.com/business/banking-finance/article/3225383/chinas-private-pension-market-could-be-us969-billion-opportunity-foreign-firms-2030-kpmg-report

- https://www.soa.org/4a56e4/globalassets/assets/files/resources/research-report/2023/insurers-developing-third-pillar.pdf

- https://finance.sina.com.cn/jinrong/yh/2024-09-19/doc-incpstrn3685136.shtml (in Chinese)

- https://www.scmp.com/business/banking-finance/article/3225383/chinas-private-pension-market-could-be-us969-billion-opportunity-foreign-firms-2030-kpmg-report

- https://assets.kpmg.com/content/dam/kpmg/cn/pdf/en/2023/06/china-pensions-reform.pdf

- http://www.cbimc.cn/content/2024-04/03/content_513194.html

- https://assets.kpmg.com/content/dam/kpmg/cn/pdf/en/2023/06/china-pensions-reform.pdf

- https://group.pingan.com/resource/pingan/IR-Docs/2023/Ping-An-Corporate-PPT--FIN-_compressed-2023.pdf