Insights, Events and Videos

Around the world, public finances are being challenged by the high retirement and health care costs of increasingly silver populations. Nowhere is this more evident than in China, which has one of the largest and fastest-growing silver populations in the world.

Fortunately, as these seniors were able to work in an era when China’s economic growth was unequaled, they’ve amassed the kind of wealth few generations before them have achieved.

According to the latest census released in 2021, China’s population aged 60 and over reached more than 260 million residents, a population expected to exceed 300 million by 2025.

Even before 2020, China’s silver economy was flexing its financial muscle, and the Covid-19 pandemic only accelerated that trend. It is expected that China’s silver spending will triple from $750 billion to $2.1 trillion in 2030, overtaking Japan to become the second-largest silver economy in the world after the U.S.

A New Driver of Value Growth

The holding conglomerate Ping An launched an innovative Chinese “managed care model” by combining differentiated health care services with financial businesses. “I think when we are creating something, there are obviously lots of challenges,” says Jessica Tan, co-CEO of Ping An Group. “There are challenges in the market, because you’re trying to create demand for a new set of products and services that nobody has really seen before.”

Ms. Tan cites the company’s new elderly home care services: “In elderly home care we have four different companies—our life insurance company, our Good Doctor health care services, another team providing the online butler and another team on health care offline services.”Our comprehensive senior care services cater to China's growing silver population, effectively harnessing the potential of the silver economy.

The “Insurance + home-based elder care” service is now offered in 47 cities in China, with some 530 associated services covering remote health care and medical monitoring as well as butler concierge services. There is also a premium product for those who prefer to be looked after in a community home, “Insurance + high-end elder care,” a seven-star high-end pension club with residences in select cities.

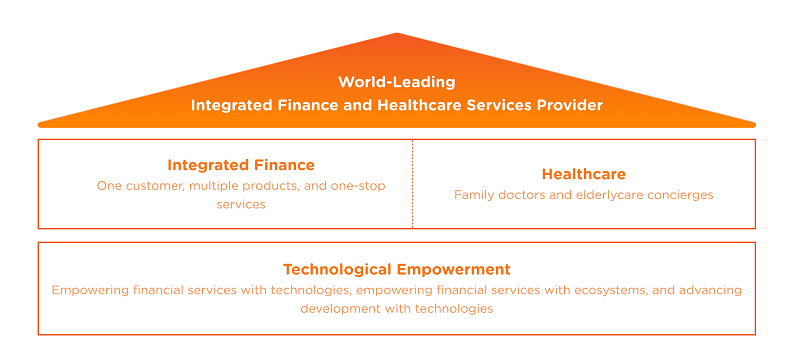

In this way, Ping An’s “integrated finance + health care” strategy empowers its core financial businesses by providing one-stop financial consultants, family doctors and elder care concierges to enable retail and corporate customers to enjoy what the company calls “worry-free, time-saving and money-saving” health care services. In this way, Ping An is also achieving steady, high-quality development in the growth of silver economy.

There is a synergy between Ping An’s health care ecosystem and its financial business. The more services customers use, the more likely they are to stay with the company. The health care and elderly care services has increased customer retention, stickiness and value: As of 2022, more than 65% of Ping An’s 693 million Internet users used the health care ecosystem services; 64% of its nearly 227 million retail customers used health care services. Per capita, they held approximately 3.41 contracts and 54,500 yuan ($7,720) in assets under management, or 1.6 times and 3.0 times those held by nonusers of these services, respectively. At the end of the first quarter of this year, the number of Ping An customers reached almost 229 million, 64% of whom used the company’s health care services.

“We’re celebrating our 35th year this year”, says Ms. Tan. “In the grand scheme of things, we are a very young company. And I am sure we will continue.”By leveraging this synergy, Ping An expands alongside the silver economy, accquiring additional resources that can be allocated to provide and improve healthcare services for the silver population in China.