Insights, Events and Videos

Aging populations the world over are generally viewed as a demographic burden and a growing dead hand in the economy. But a recent U.S. report1 identified America’s “retirees with money” as the economy’s secret weapon.

As it turns out, this group of over-65s has been helping to keep the U.S. economy resilient in the face of rising interest rates. They make up 18% of the population,2 their finances are relatively healthy and they accounted for 22% of spending last year. This is the highest share since the U.S. Labor Department began surveying consumer expenditures in 1972.3

China’s elder care is often described as a “9073”: 90% home-based, 7% community care and 3% in nursing homes.7 Traditionally, caring for the elderly was a family concern. But as the Ping An group’s co-CEO, Jessica Tan, points out, this approach is now becoming a social challenge and a demographic challenge. In China, on average, there are five family members to look after each elderly person. Over the next 30 years, this ratio is expected to drop to 1.5. As Tan explains: “China’s family units are rapidly shrinking as more offspring are born as only children.”8

As family units shrink, the question is: Who will provide care for this burgeoning elderly generation? Who will pay, and who will integrate services or bring all of them together to make elderly care viable?

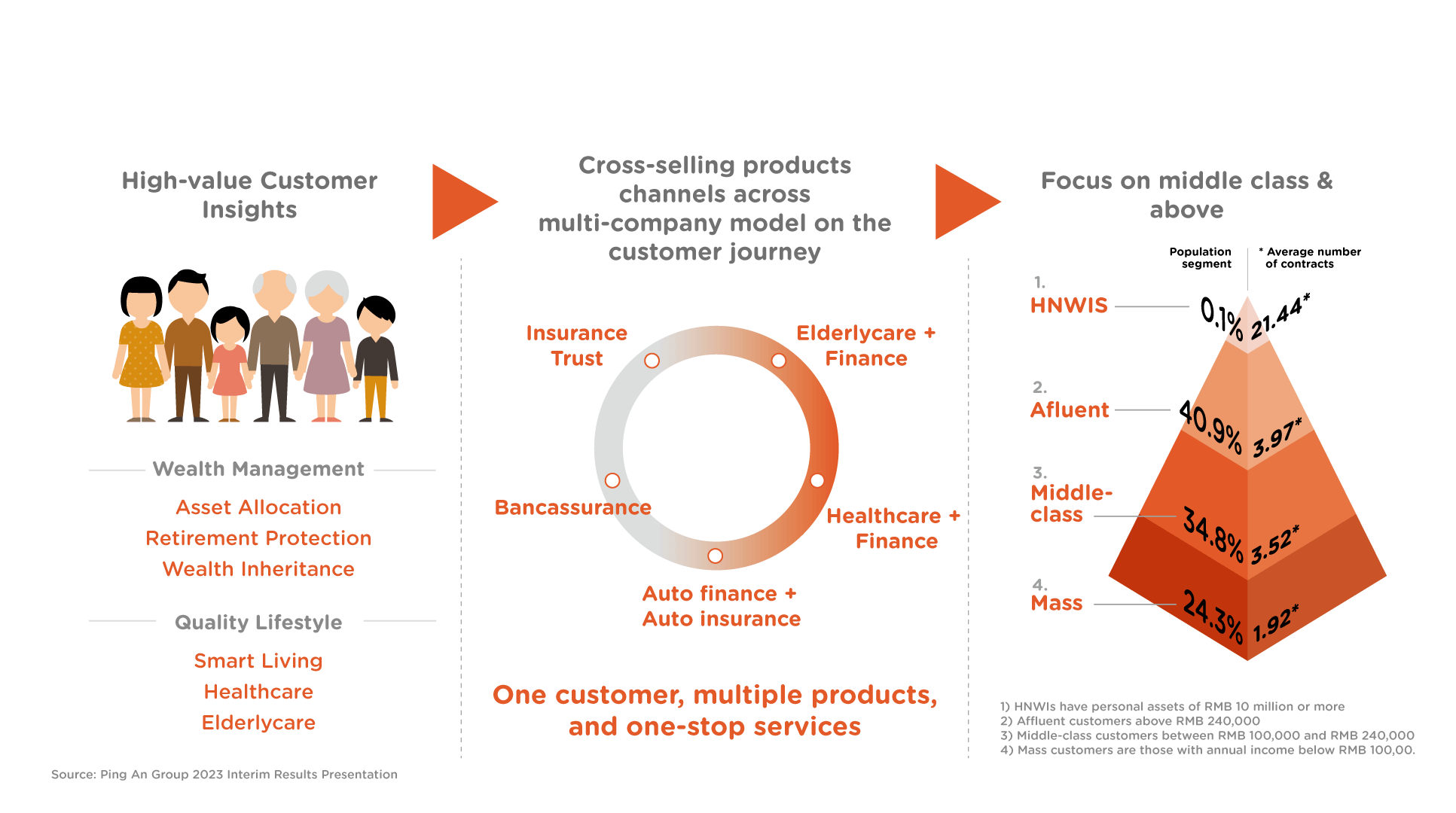

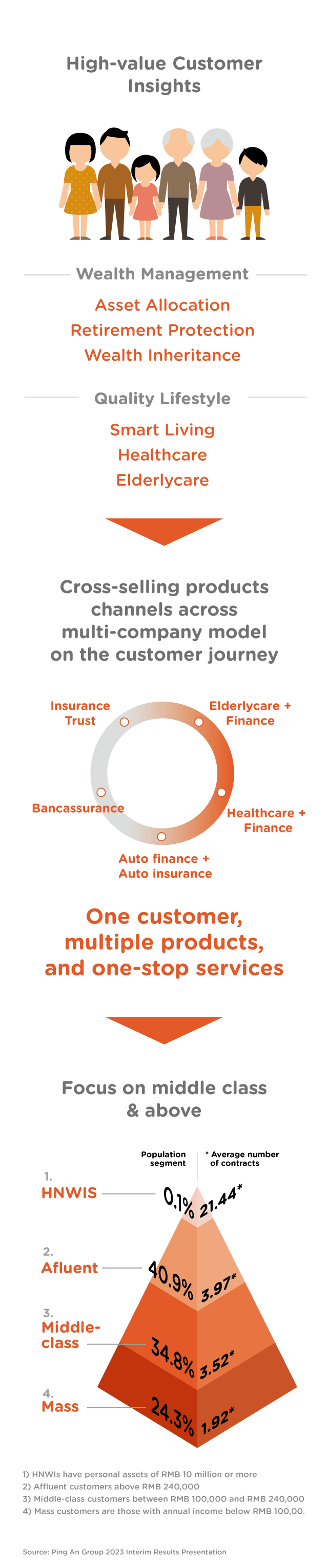

The healthcare business model offers elements similar to those of the U.S.-based United Health. Ping An acts as a payer in the ecosystem, integrating insurance with healthcare and elderly care services. In addition, the company owns a premium network of hospitals and partners with 3A hospitals as well as a vast network of clinics. Its elderly care includes home-based care covering medical and lifestyle needs through family doctor, butler and concierge service.

Ping An is using healthcare as a differentiator with customers and a hedge against competitors. Speaking at a recent meeting of investors, Tan said that while peers can copy the offering superficially, they lack a healthcare ecosystem. “To provide credible healthcare offerings,” she said, “first you need proprietary resources, and then secondly, particularly in China, it is super challenging. You need to build a health network, and it’s not that easy to build a health network in China, particularly if you’re not a domestic player. So we see healthcare as a new driver of value growth.”

So how is it working? Does this integrated finance platform with a healthcare ecosystem and elderly care get results?

In the first nine months of 2023, Ping An achieved over 110 billion yuan ($15 billion) in health insurance premium income. Customers entitled to service benefits in the healthcare ecosystem accounted for approximately 68% of Ping An Life’s net book value. As of September 2023, nearly 64% of Ping An’s nearly 230 million retail customers used services from the healthcare ecosystem. They held approximately 3.42 contracts, compared with a company average of 2.99 contracts, and 56,100 yuan in assets under management per capita, or 1.6 times and 3.4 times those held by nonusers of these services, respectively.

Ping An integrates proprietary medical resources with commercial insurance to unlock potential value. Watch the video to hear the Ping An agent Lin Bin talk about the importance of customer focus in retaining customer loyalty.

Elite Agent Lin Bin Talks Customer Focus

1WSJ, “The U.S. Economy’s Secret Weapon: Seniors With Money to Spend,” loaded Oct. 25, 2023

2WSJ, “The U.S. Economy’s Secret Weapon: Seniors With Money to Spend,” loaded Oct. 25, 2023

3U.S. Labor Department’s survey of consumer expenditures report, loaded Oct. 25, 2023, U.S.

4“Get the Facts on Older Americans,” National Council on Aging, Inc., loaded Oct, 26, 2023

6From previous partner copy, formal reference to follow, loaded July 5, 2023

7“China’s Elder Care Policies 1994–2020: A Narrative Document Analysis,” loaded July 6, 2023

8From previous content, formal reference to follow, loaded July 5, 2023