Insights, Events and Videos

Online “consumer lifestyle ecosystems” have become the Holy Grail for tech companies across the world, allowing customers to access and consume multiple products and services conveniently and quickly, and tech companies to hold customers’ interest for longer.

One-stop services ecosystems have so far proven elusive in the west, but multi-use “everything” apps started to appear in China about a decade ago, aiming to cater to consumers’ many lifestyle needs. An integrated finance ecosystem created by China-based Ping An Group — one of the world’s largest insurance companies — now allows hundreds of millions of customers to enjoy financial, car-related and healthcare services in a single, one-stop solution. More than 11mn cars have been bought and sold through its portal.

“We have 229mn retail customers,” says Michael Guo, the new co-chief executive at Ping An, who believes in combining digital technology and apps behind the scenes to create simplicity for the end user. “Our vision is to become a world-leading integrated finance and healthcare service provider — to serve one customer with multiple products and services, and with healthcare and elderly care services,” says the former Boston Consulting global partner and managing director.

Xie Yonglin — also co-chief executive at Ping An — believes there is a strong case for “integrated finance plus healthcare” in China, where, according to the OECD’s most recent data, households have the highest ratio of savings to disposable income in the world, at almost 35 per cent.1 UBS, meanwhile, says China is the second largest wealth management market in the world after the US.2 And the China is set to grow bigger, with McKinsey predicting that personal financial assets in the country will more than double in 10 years, from Rmb243tn ($33tn) in 2022 to Rmb571tn in 2032.3

The business model goes beyond wealth management, says Ping An’s third co-chief executive, Jessica Tan. “In China, as in the US and Japan, we find as people get richer and society ages, they are seeking high-quality healthcare and elderly services,” she says.

Per capita health expenditure in China was about ¥5,000 in 2021, with a compound annual growth rate (CAGR) of 13 per cent over the past decade, according to data from the National Bureau of Statistics of China. This compares to ¥30,000 in Japan and ¥24,000 in Singapore, with CAGR of 1 per cent and 9 per cent, respectively, says data from the World Bank.

“China has one of the largest and fastest-growing ageing populations in the world,” Tan says.4 Indeed, the World Health Organization expects China’s over 60s to exceed 28 per cent of its total population by 2040. That equates to 400mn people, more than the total population of the US today.5 “The entire senior-care industry is expected to exceed Rmb22tn,” Tan adds.

Through the Ping An healthcare ecosystem, which boasts elements of the United Healthcare business model in the US, the company acts as a payer and integrator of medical healthcare and elderly care. The new model was years in the making, says Tan, with Ping An developing an “integrated finance + healthcare” framework to provide professional “financial advisory, family doctor and elderly care concierge” services.

So, is it working? Is Ping An’s integrated finance ecosystem succeeding where others have failed?

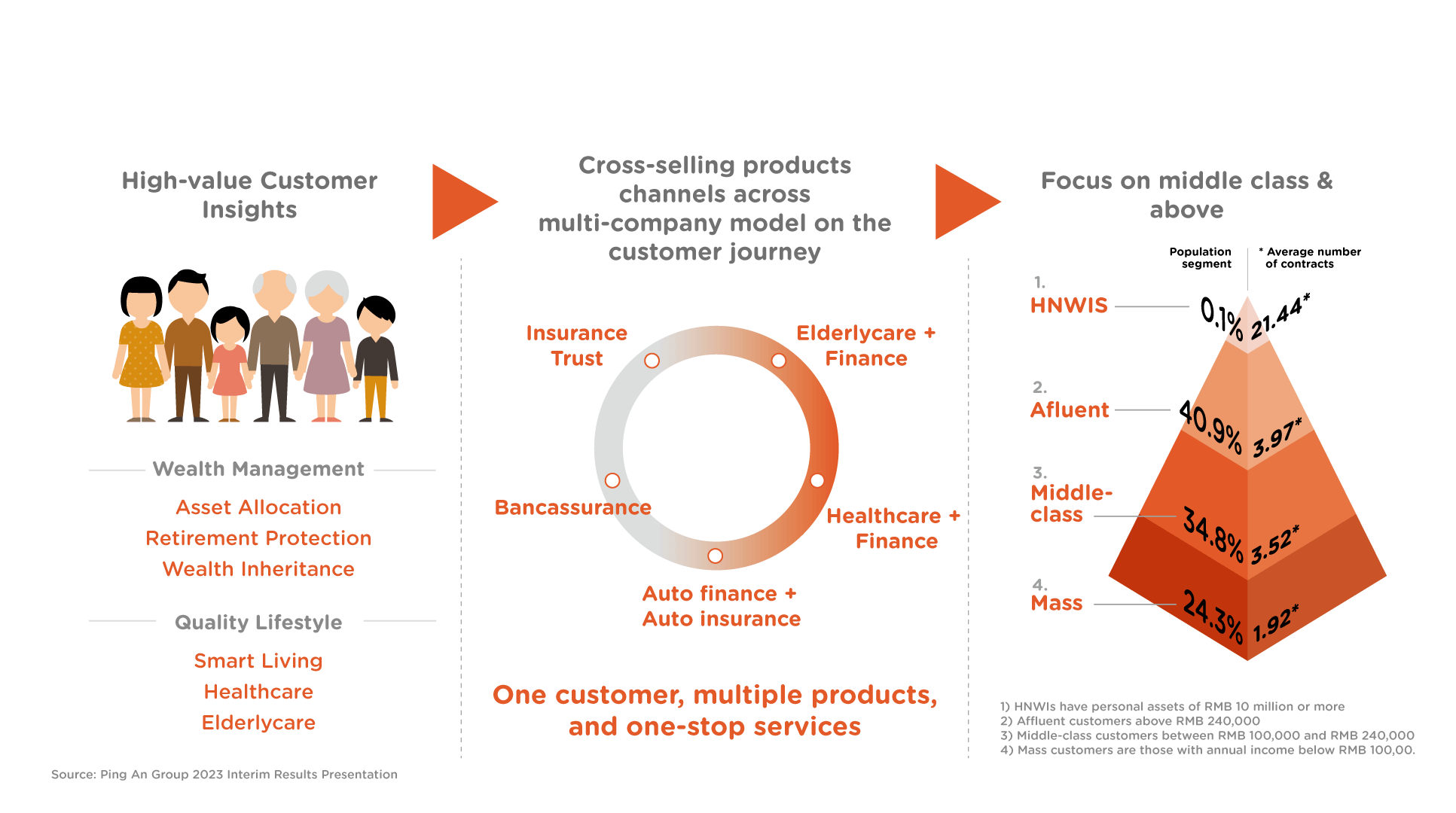

A basic measure of success is the number of products accessed per customer. Total customer numbers over the past five years have jumped from 166mn to 229mn, says Xie, with contracts per customer rising from 2.3 to 2.99. Another marker of success is ecosystem “stickiness”, with customers with more wealth holding more contracts. As of the end of June, customers deemed to be middle class and above accounted for more than 75.7 per cent of the group’s total retail customers. The average number of contracts per high-net-worth customer reached 21.44.

In the first half of 2023, 29.7 per cent of Ping An’s new customers were sourced from the healthcare ecosystem, says Tan. Customers enjoying service benefits of the healthcare ecosystem in the first half of 2023 contributed more than 68 per cent to Ping An Life’s new business value.

At the end of June, over 64 per cent of Ping An’s 229mn retail customers had used its healthcare services, with 3.43 contracts per customer and assets under management of Rmb55,800 per customer. These figures are 1.6 and 3.2 times higher, respectively, than for customers who do not use healthcare ecosystem services.

“The Healthcare ecosystem empowers the core financial businesses,” says Tan, as Ping An continuously develops its integrated finance model of “one customer, multiple products and one-stop services”.

<End>

1. OECD Data, loaded 2023, Oct, 25

2. Shorrocks, Anthony; Davies, James; Lluberas, Rodrigo (2023). Global Wealth Databook 2023. UBS and Credit Suisse Research Institute., loaded 2023, Oct, 25

4. This is from previous partner copy, formal reference to follow, loaded 2023 July 5

5. World Health Organisation, Aging and health, Aging and Health in China, loaded 2023 July 5